In today's world, investors are increasingly seeking out ways to put their capital to work not just for financial returns, but also for positive social and environmental impacts. That’s where Impact Investments from DGB Group come in. Our Impact Investments are designed with both financial gain and positive environmental and social outcomes in mind.

Two people passing a tree seedling in an African nursery. AI generated picture.

Two people passing a tree seedling in an African nursery. AI generated picture.

With a firm commitment to sustainability and community upliftment, DGB has developed Impact Investments as a groundbreaking investment vehicle that goes beyond profit margins. It offers a real chance to contribute to global sustainability while securing competitive returns for your portfolio.

What sets Impact Investments apart?

At the core of Impact Investments is the principle of impact investing—where financial capital is used to generate measurable environmental and social outcomes alongside strong financial returns. Unlike traditional investments, which focus solely on monetary gains, Impact Investments are designed to channel funds directly into high-impact nature-based and livelihood projects that restore ecosystems, protect biodiversity, and support local communities around the world.

From planting trees to improving clean water access and promoting sustainable agriculture, Impact Investments are aligned with nature-based solutions that benefit both the environment and society. This balance of impact and financial reward makes these investments is an ideal opportunity for those seeking to align their portfolios with their values.

Why Impact Investments offer unique benefits

If you're looking for a product that provides both financial returns and a lasting legacy, Impact Investments deliver on both fronts. Here are the key advantages of investing in these investments:

- Competitive returns: With an 8% return, Impact Investments offer market-competitive rates, providing you with the chance to grow your wealth while contributing to meaningful causes.

- Resilient, long-term value: The projects funded by these investments are built to withstand environmental and regulatory challenges, ensuring that your investment remains stable over time.

- Direct impact on the ground: Each project you fund contributes to real-world environmental and social improvements, whether through beehives, renewable energy, or community-based initiatives.

- Global scope: Your investment spans across different sectors and countries, providing diverse exposure to high-impact sustainability projects.

- Lower financial risk: High demand for green financing typically lowers borrowing costs, making Impact Investments generally a less risky investment option for socially conscious investors.

Download the Impact Investments brochure to find out more

Illustration showing the benefits of impact investing.

Illustration showing the benefits of impact investing.

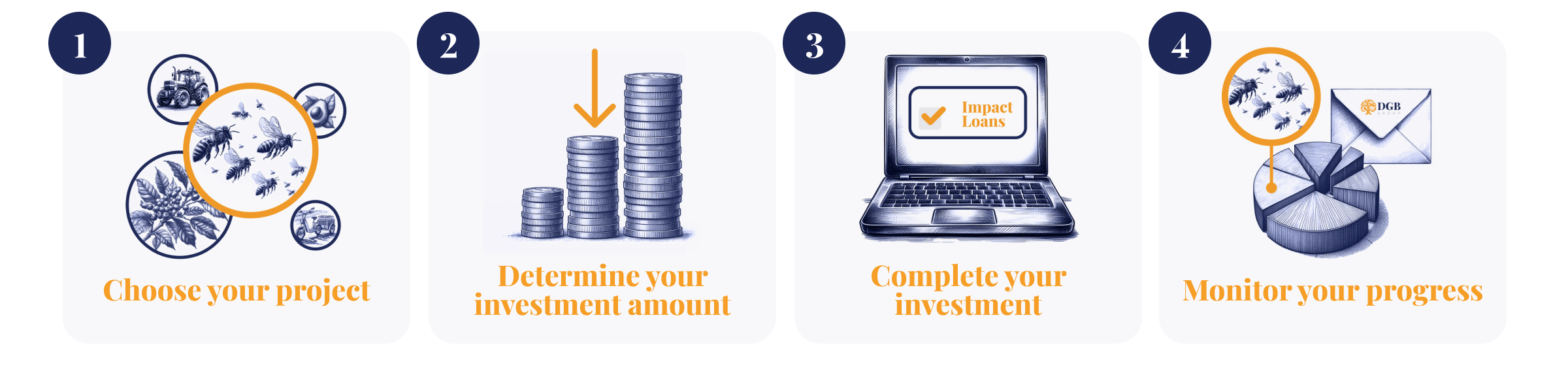

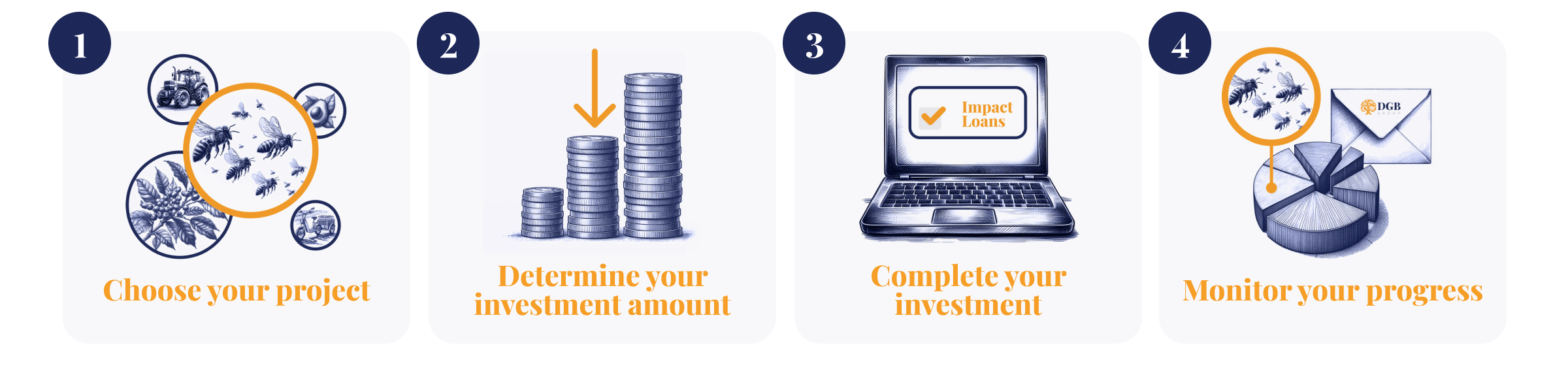

How to get started with Impact Investments

DGB has made the process of investing with impact easy. In just a few steps, you can begin funding projects that matter:

1. Choose your project: Browse through DGB’s portfolio of sustainability projects and select the one that aligns with your values and goals.

2. Determine your investment amount: Once you’ve found the right project, decide how much you’d like to invest.

3. Complete your investment: Securely submit your investment and watch your capital start working for both financial returns and environmental benefits.

4. Monitor your progress: Track the impact and performance of your investments through DGB’s easy-to-use online platform, where regular updates keep you informed about the real-world change your money is making.

Illustration showing the step-by-step process: how to get started with Impact Investments.

Illustration showing the step-by-step process: how to get started with Impact Investments.

The Kenya Beehive Project: a case study in impact

Our first standout initiative available through Impact Investments is the Kenya Beehive Project. This project addresses two pressing global issues—biodiversity loss and rural poverty. By providing beehives and expanding sustainable beekeeping practices, the project increases bee populations essential for healthy ecosystems while also providing a vital source of income for Kenyan farmers.

This project supports the installation of 1,000 beehives across 5,000 hectares, benefiting 200 local farmers and increasing bee populations by 50%. By enhancing pollination and providing honey products that the farmers can sell, the project contributes to a ±2.5% increase in farmers' income, promoting both agricultural productivity and sustainability.

Farmers and beehives. Kenya Beehive Project, DGB.

Farmers and beehives. Kenya Beehive Project, DGB.

This impact investing project offers bonds priced at €500 each. Investors can expect an annual return on investment (ROI) of 8% for 4 years. Interest payments are made quarterly, providing consistent returns over the course of the investment.

Through your investment, farmers receive beehives and training and the tools they need to sustainably grow their beekeeping operations, which leads to increased honey production, enhanced biodiversity, and a stronger local economy. This is just one of the many examples of how Impact Investments offer both environmental restoration and financial returns.

Invest in the Keenya Beehive Project

Why Impact Investments are the future of investing

The financial world is increasingly moving towards investments that combine profitability with social and environmental responsibility. Impact Investments are not just another green investment option; they represent a powerful way to actively contribute to global sustainability while earning competitive financial returns.

Photos representing Impact Investments of DGB.

Photos representing Impact Investments of DGB.

For those who seek more than just profits—who want their investments to be a force for good—Impact Investments offer an exceptional opportunity. Whether your focus is on biodiversity, renewable energy, or community development, there’s a project in our portfolio that will resonate with your values and help you create a lasting impact. We have about 20 sustainability projects in our pipeline for you to choose from.

Be part of the global sustainability movement

At DGB, we are proud to be at the forefront of this new era of impact investing. By offering Impact Investments at an 8% annual return, paid quarterly, we’re enabling investors like you to play a pivotal role in shaping a sustainable future for our planet. Every investment you make helps restore ecosystems, uplift communities, and protect the natural world, all while delivering attractive financial returns.

Now is the time to act. Take the first step towards making your investments truly count—start exploring Impact Investments today, and make your capital work for both the planet and your portfolio.