In December 2022, 190 governments reached a landmark agreement at the United Nations biodiversity conference (COP15) to protect nature and ecosystems. The Kunming-Montreal Global Biodiversity Framework (GBF), as the COP15 agreement is known, aims to protect 30% of the planet's land and water by 2030 and phase out subsidies that harm nature. The agreement calls for all countries that ratified it to map out national action plans that could, among other steps, introduce regulations requiring companies and investors to publish their nature-related risks, dependencies, and impacts.

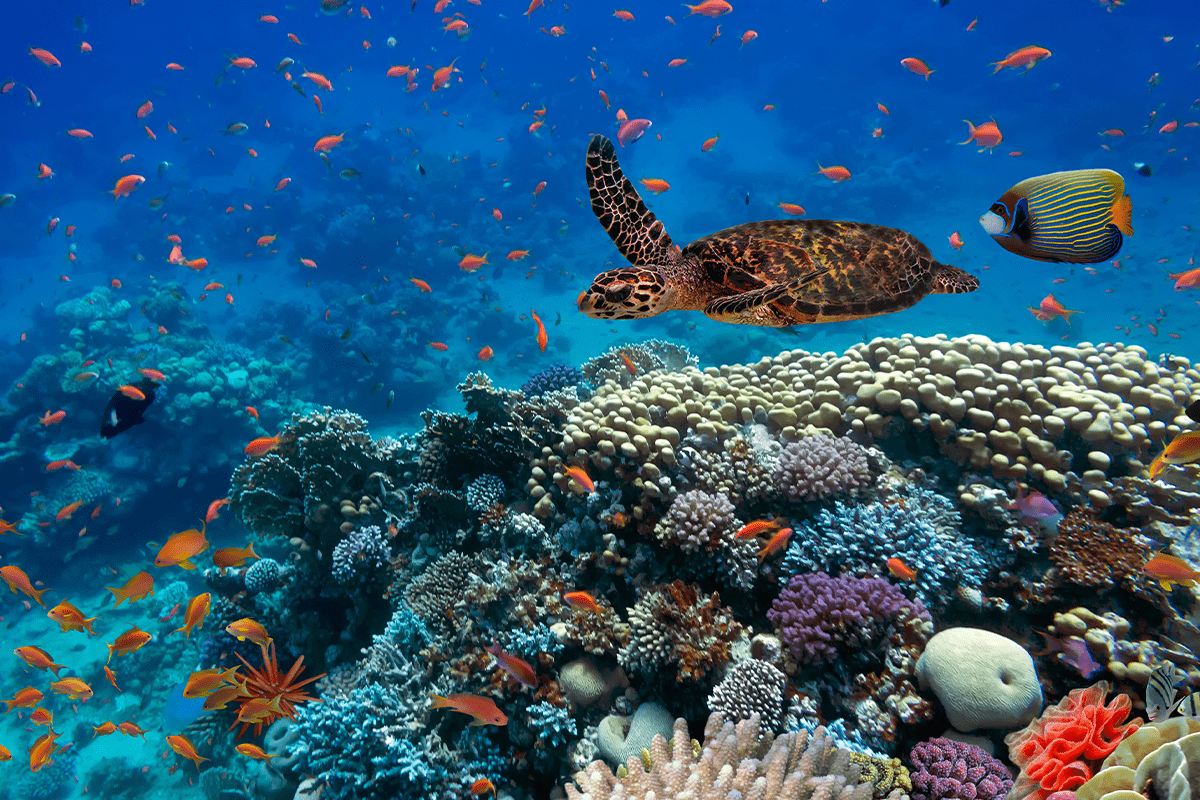

.png?width=1200&height=800&name=How%20biodiversity%20loss%20and%20COP15%20affect%20investors_visual%201%20(1).png) Giraffes in Tsavo West National Park in Kenya.

Giraffes in Tsavo West National Park in Kenya.

The significance of biodiversity loss for investors and the economy

Biodiversity loss is an issue that matters for investors, as more than half of the world's economic output is either highly or moderately dependent on intact ecosystems and their benefits, which include food and timber, climate control, soil formation, water and air purification, and pollination. Earth's biological diversity ensures that these natural processes function. Yet both biodiversity and ecosystems are dwindling at an unprecedented rate. Three-quarters of terrestrial ecosystems and two-thirds of the oceans have been negatively affected by human activities, and a quarter of existing animals and plant species could face extinction. The destruction of natural habitats, overharvesting of resources, pollution, a changing climate, and the introduction of invasive species all fuel biodiversity loss.

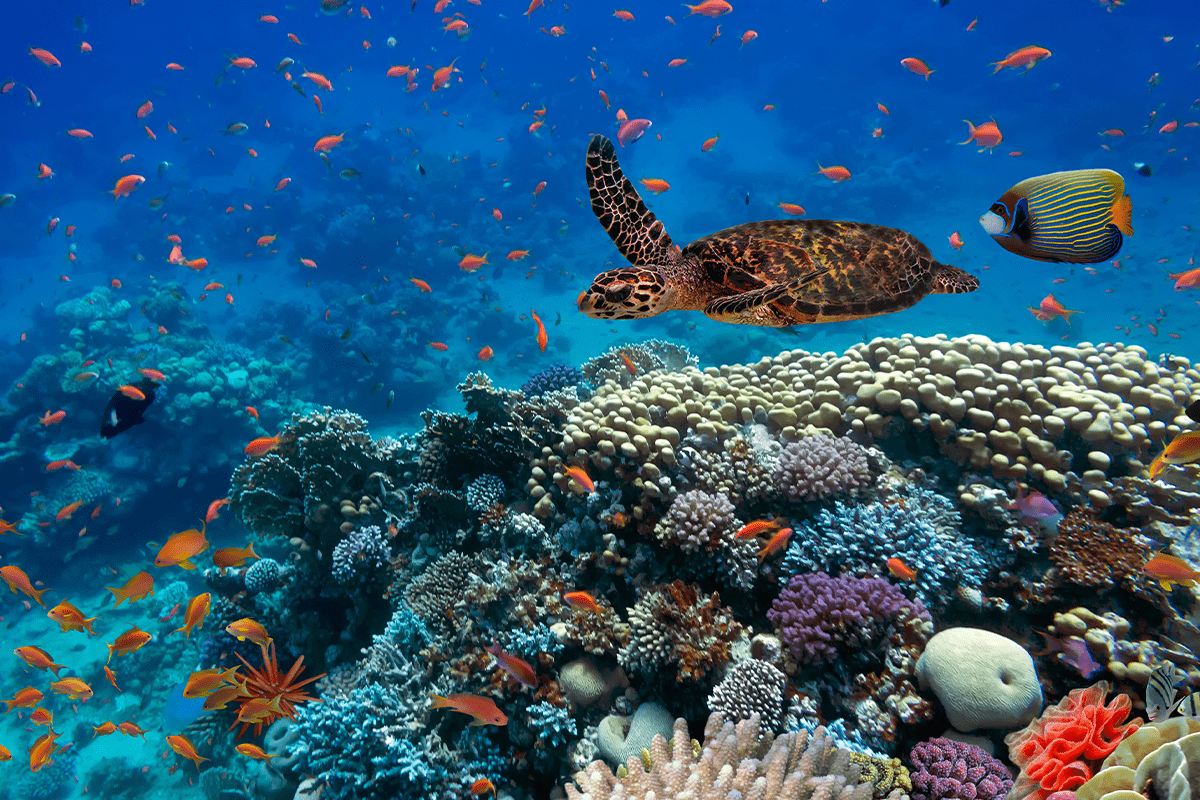

Tropical fish and turtle in the Red Sea, Egypt.

Tropical fish and turtle in the Red Sea, Egypt.

The Global Biodiversity Framework goals

The GBF and its targets could serve as a road map for investors and other capital-markets participants to address biodiversity loss. The GBF lays out four overarching goals for conserving and restoring biodiversity and natural ecosystems by 2050 and 23 specific targets for action this decade. The GBF could lead to more development aid as well as blended capital earmarked for conservation. It aims to mobilise at least $200 billion a year globally for conservation by 2030 from both public and private sources, with the goal of reaching $700 billion a year by mid-century. The mechanism envisions countries receiving compensation for designating biodiversity-rich areas for protection.

Read more: Biodiversity reporting: Why corporates must take a quantitative approach

The GBF also calls for multinational companies and financial institutions to measure and report their biodiversity-related risks, dependencies, and impacts, including throughout their operations, investment portfolios, and supply and value chains. Companies should also supply consumers with information to promote sustainable consumption. Although the GBF leaves the specifics of such disclosures to national regulators, emerging frameworks in Europe and the United States echo this directive. The European Union is developing extensive biodiversity-related reporting requirements consistent with its 2030 biodiversity strategy. Other countries are following suit.

The GBF is also likely to energise efforts to standardise reporting of nature-related financial risk. The Taskforce on Nature-related Financial Disclosures aims to complete a voluntary reporting framework modelled on the Task Force for Climate-related Financial Disclosures this September. It is among a series of initiatives designed to help investors measure and report on nature-related risks and engage companies on biodiversity. The International Sustainability Standards Board said it would make nature-related risk part of its developing disclosure framework.

Read more: 5 Ways businesses can implement the new Global Biodiversity Framework

The implications of biodiversity loss for investors and the opportunity for sustainable investment

Investors should pay attention to the implications of biodiversity loss, as it can exacerbate climate concerns and affect the sustainability of businesses in industries that depend on natural capital. The GBF presents an opportunity for investors to align their investments with sustainability goals and address the financial risks and opportunities associated with biodiversity loss. Companies and investors can also benefit from proactively addressing their nature-related risks, dependencies, and impacts and disclosing them to their stakeholders.

Explore the benefits of green investing

At DGB Group, our commitment to conserving nature and fostering biodiversity continues to drive our value proposition. As a company focused on environmental restoration, we believe the success of the nature market is vital to achieving our business goals while also positively impacting the environment. By participating in the nature market via nature-restoration projects, carbon and biodiversity credits, and green bonds, we can help companies and investors reduce their carbon footprint and contribute to a greener, more sustainable future. The potential for growth in the nature market is enormous, and we are excited to be at the forefront of this movement, helping to shape the industry and drive positive change for the planet. Businesses, investors, and individuals can choose among our solutions and support nature in the most accessible and transparent way.

Contact us today to start your sustainability journey

.png?width=1200&height=800&name=How%20biodiversity%20loss%20and%20COP15%20affect%20investors_visual%201%20(1).png)