Ecuador has successfully closed its largest ‘debt-for-nature’ exchange, securing $12 million annually for the conservation of the Galapagos Islands, renowned for their unique ecosystems. The country recently repurchased approximately $1.6 billion of its debt at a discounted rate with the assistance of Credit Suisse. Ecuadorian Foreign Minister Gustavo Manrique Miranda emphasised biodiversity's significance, stating its considerable value.

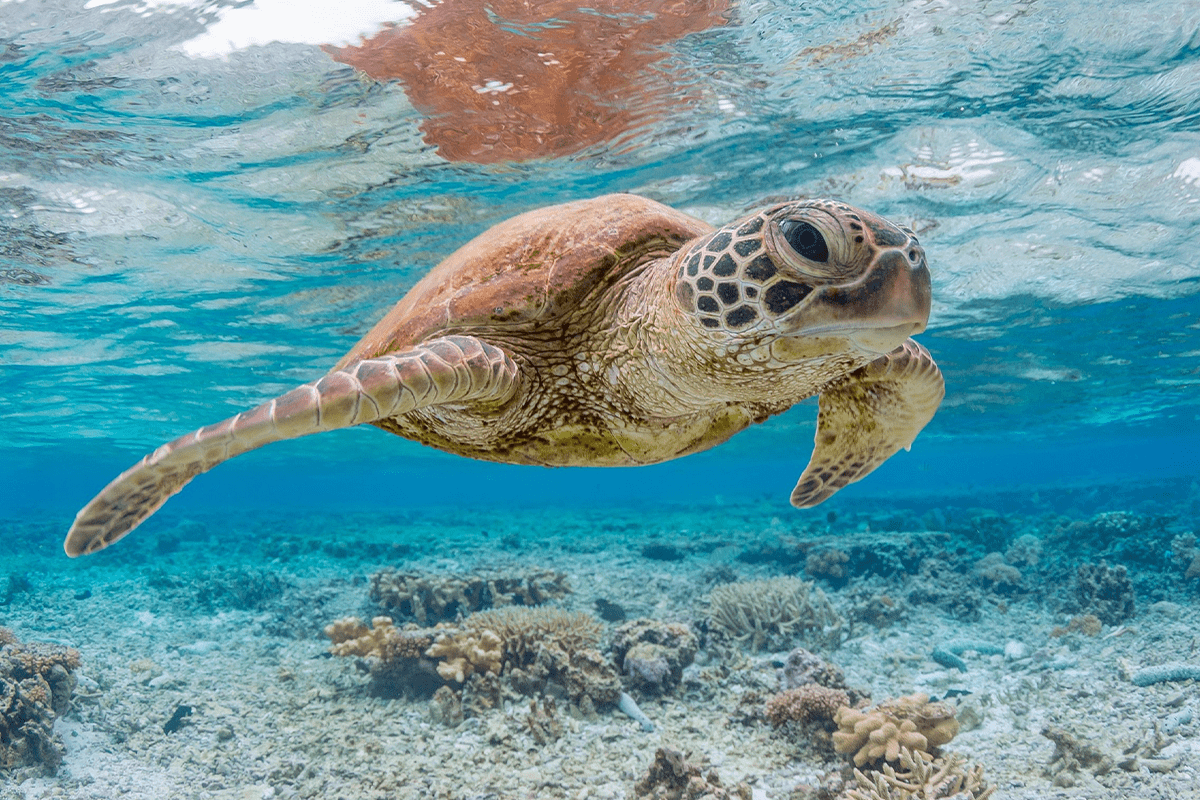

View of the Bartolomé Island, Galapagos.

View of the Bartolomé Island, Galapagos.

Investing in nature preservation not only safeguards wildlife and habitats but also yields climate benefits by protecting carbon sinks such as forests and seabeds. As a result, debt-for-climate swaps are gaining popularity. The newly introduced ‘Galapagos Bond’ worth $656 million, set to run until 2041, offers investors a 5.6% interest rate. Unlike Ecuador's sovereign bonds, currently yielding between 17% and 26%, the Galapagos Bond entails an $85 million credit guarantee from the Inter-American Development Bank and $656 million political risk insurance from the US International Development Finance Corp, mitigating risks associated with the investment.

Prior debt-for-nature exchanges in Belize, Barbados, and Seychelles have proven successful. Nevertheless, Ecuador's agreement is notably the largest, reducing the country's debt by over $1 billion after accounting for the total conservation expenditure of $450 million. The driving force behind this initiative is the remote Galapagos Islands, located approximately 600 miles off Ecuador's mainland coast, which inspired Charles Darwin's Theory of Evolution. The islands are home to numerous species, including giant tortoises, marine iguanas, and Darwin's finches, found nowhere else on Earth, underscoring the critical importance of their conservation.

Read more: Innovative debt swap: Gabon funds marine conservation with Bank of America's support

While Ecuador's government will allocate over $1 billion in savings from the debt repurchase for other purposes, the primary focus of this deal lies on the environmental advantages and the hope that this deal will serve as a catalyst for other heavily indebted countries with rich biodiversity. Giuseppe Di Carlo, director of the Pew Bertarelli Ocean Legacy, expressed enthusiasm, describing the $12 million annual allocation for conservation, along with an additional $5 million placed into a long-lasting fund, as an ‘extraordinary win’.

To ensure the adequate protection of the Galapagos Islands, regular monitoring will be conducted by a newly established entity, which will oversee conservation efforts and regulate ‘purse seine’ and ‘longline’ fishing vessels. The success of Hawaii's Papahānaumokuākea marine park, which safeguards a 200-mile radius around the archipelago, has served as a potential model for this initiative. This conservation funding has not only revived local tuna and fish stocks but also increased catches in areas where local fishing is permitted.

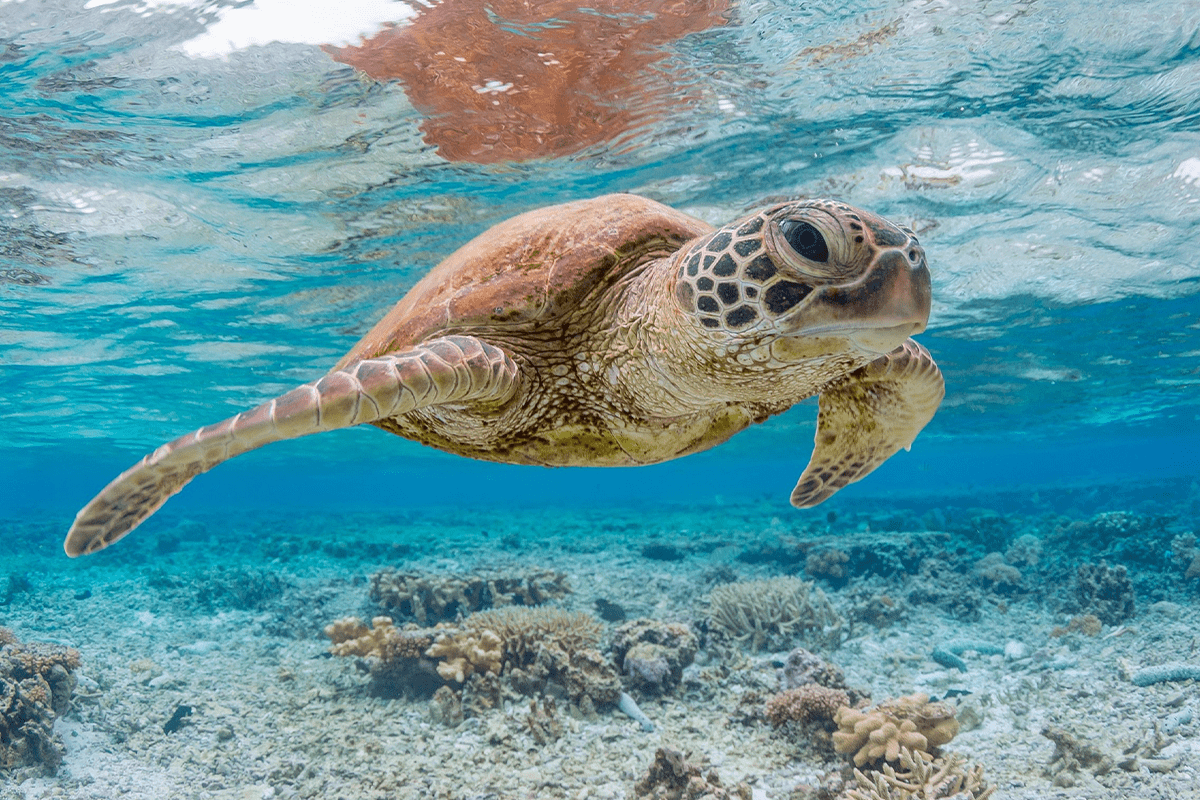

Sea turtle swimming nearby Galapagos islands.

Sea turtle swimming nearby Galapagos islands.

Anticipating similar positive outcomes, Ecuador established a new reserve last year spanning 11,500 square miles between the Galapagos Islands and Costa Rica's maritime border, serving as a migratory route for sharks, whales, sea turtles, and manta rays.

Read more: How to protect the oceans and marine life

Scott Nathan, the CEO of the US International Development Finance Corp, hinted at the possibility of comparable agreements in other countries, stating that people should ‘stay tuned’. The Galapagos deal was a long time in the making, first proposed over three years ago. Despite facing challenges during the final stages due to political turbulence, including attempts to impeach President Guillermo Lasso, the agreement's economics were bolstered by reduced bond prices. Furthermore, the deal had to navigate the difficulties encountered by key lender Credit Suisse, which required an emergency acquisition by UBS in March.

Despite the turbulence, it is important that the interest in nature prevails, and the success of Ecuador’s deal proves this. At DGB Group, we put nature first. All our endeavours are directed at helping nature thrive and prosper. We work with various stakeholders, from governments to regulators, who share this incredible vision, and these fruitful collaborations bring benefits to everyone involved.

You can make a difference too–contact our team