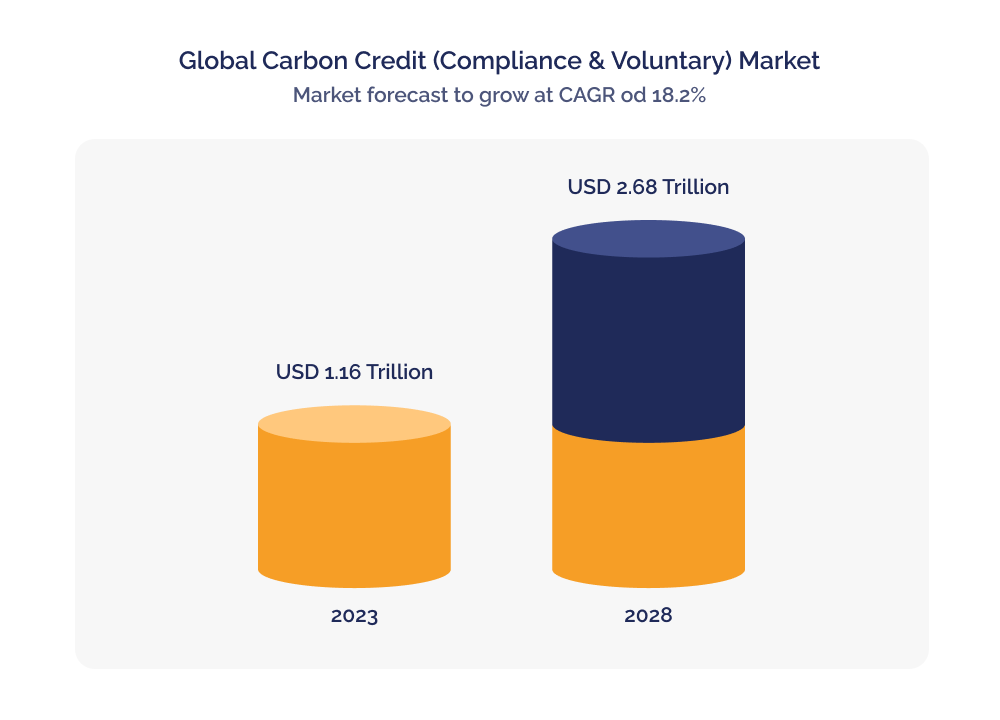

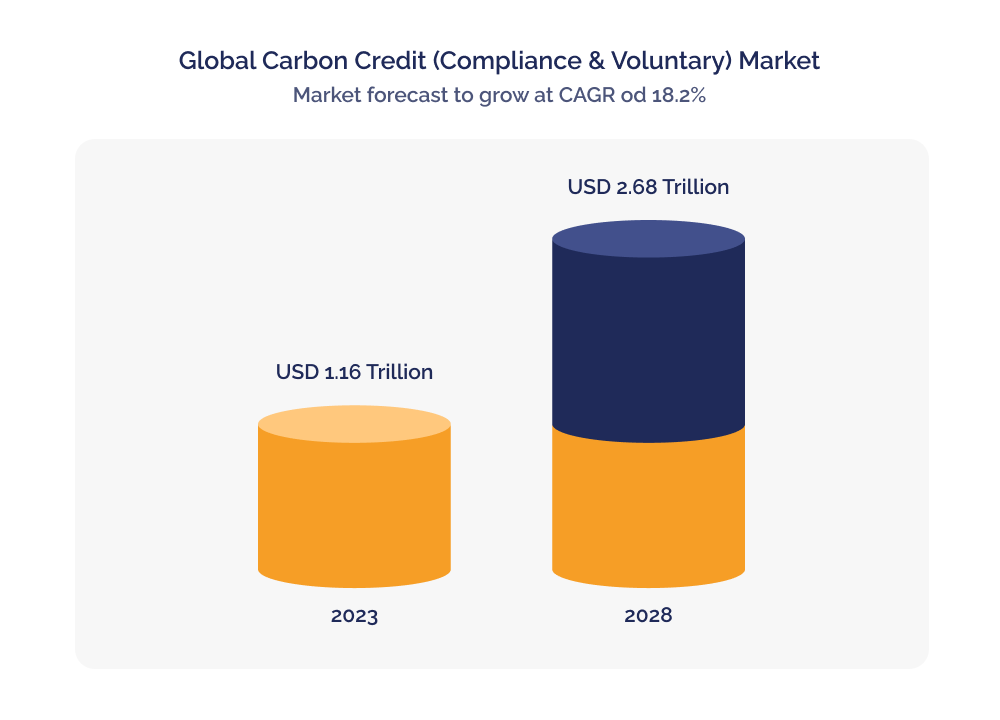

Carbon credits have been a lot in the news lately, and for a good reason. In 2022, the global carbon credit market’s traded value was worth a whopping $978.56 billion, and it's expected to grow to $2.68 trillion by 2028, as shown by a new study. The market’s traded volume is forecasted to increase from last year’s 13.22 gigatonnes of equivalent carbon dioxide to 19.57 gigatonnes of equivalent carbon dioxide. The global traded value is determined to grow at a compound annual growth rate of 18.23% during the forecast period of 2023–2028. At the same time, the traded volume is expected to grow at a compound annual growth rate of 6.78%.

The study attributes the market’s growth to factors such as increasing carbon emissions, rising corporate efforts in carbon offsetting, the adoption of net zero targets, demand for natural climate solutions, and the establishment of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). Strong price actions in the world's most liquid carbon markets highlighted carbon as a barometer for global climate policy actions and an emerging asset class.

According to the study, high carbon prices are necessary for carbon removal forestry projects, for blue hydrogen to become cost-competitive with grey hydrogen, and to decarbonise hard-to-abate sectors like steel and cement. It further emphasises the importance of taking action to reduce carbon emissions as the longer nations defer, the higher and faster carbon prices would have to rise to achieve the current sustainability objectives. In short, the growth of the global carbon credit market is being driven by a combination of factors, and high carbon prices are essential for achieving climate objectives.

Forecasted market growth 2023–2028, source: Global Carbon Credit Market: Analysis by Traded Value, Traded Volume, Segment, Project Category, Region, Size and Trends with Impact of COVID-19 and Forecast up to 2028

Forecasted market growth 2023–2028, source: Global Carbon Credit Market: Analysis by Traded Value, Traded Volume, Segment, Project Category, Region, Size and Trends with Impact of COVID-19 and Forecast up to 2028

However, the lack of governance and unified standards poses a challenge for market participants to verify the quality of carbon credits, thereby limiting market growth. Nevertheless, there are initiatives and reviews of mechanisms that drive developments within the market to strengthen it.

Read more: What will happen in the voluntary carbon markets in 2023

The market for carbon credits is expected to experience rapid growth during the 2023–2028 forecasted period, owing to several market trends, including the increase in the number of voluntary carbon market platforms, the growth of carbon as a new investment asset class, and Article 6 of the Paris Agreement redefining global carbon offset markets, among others. The market is also expected to benefit from the emergence of new carbon credit rating agencies, which can help address one of the biggest hurdles in the voluntary carbon market: the ability to assess quality.

Furthermore, the increase in nationally determined contributions’ (NDC) net-zero targets is expected to drive demand for carbon credits further. For instance, the EU Member States have agreed to a 2030 domestic emissions target of at least 55% net reduction below 1990 levels. South Korea aims to reduce 2030 emissions by 40% below 2018 levels and achieve carbon neutrality by 2050. A recent report by the Energy & Climate Intelligence Unit and Oxford Net Zero revealed that 21% of the world's largest public companies have committed to a net-zero target, highlighting the increasing adoption of such targets and their role in driving market growth.

At DGB Group, we believe that investment in nature-based solutions is the optimal path to protect and restore nature. Therefore, we design and manage large-scale reforestation and afforestation projects that restore biodiversity and degraded land while generating high-quality carbon credits. As a leading carbon project developer in a booming carbon credit market, we are perfectly positioned for significant growth. A thriving carbon market allows us to scale our impact and achieve our goal of making nature flourish and prosper.

Contact our experts to join our mission

Forecasted market growth 2023–2028, source: Global Carbon Credit Market: Analysis by Traded Value, Traded Volume, Segment, Project Category, Region, Size and Trends with Impact of COVID-19 and Forecast up to 2028

Forecasted market growth 2023–2028, source: Global Carbon Credit Market: Analysis by Traded Value, Traded Volume, Segment, Project Category, Region, Size and Trends with Impact of COVID-19 and Forecast up to 2028