The World Economic Forum (WEF) is gearing up to launch a groundbreaking buyers club for biodiversity credits in early 2024. Several major companies are showing interest in becoming early participants, and a pilot auction is planned for an unspecified date in 2024. This initiative, confirmed by Alessandro Valentini, a sustainable finance specialist at the WEF, is part of the growing interest in the voluntary biodiversity market.

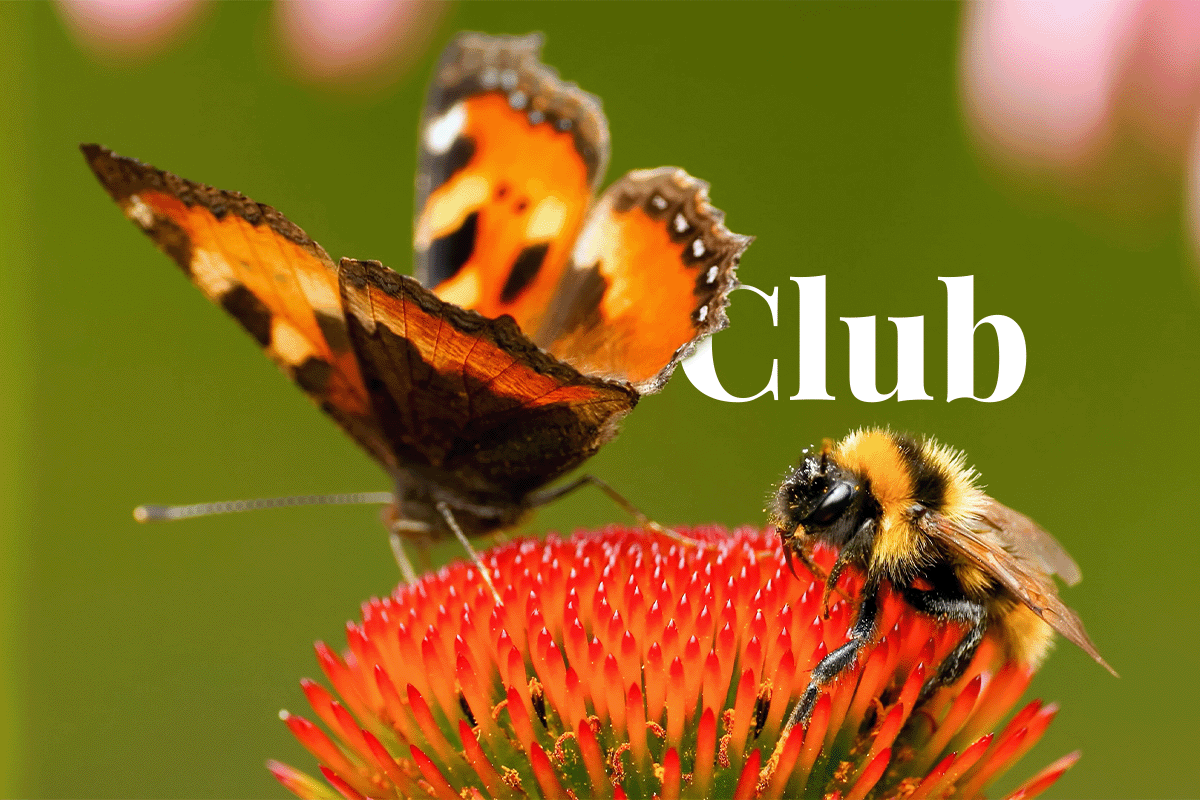

Close-up of a butterfly and a bee sitting on the echinacea flower.

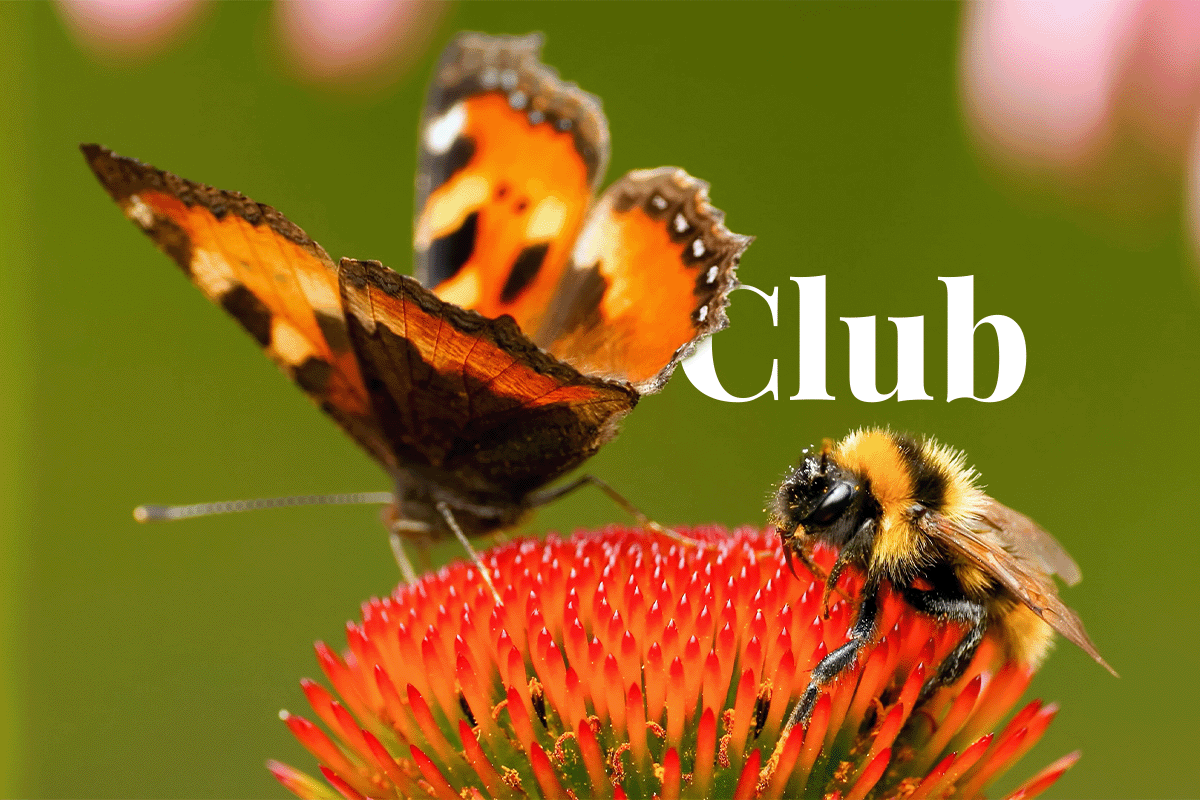

Close-up of a butterfly and a bee sitting on the echinacea flower.

The WEF is targeting corporate buyers from sectors with significant biodiversity impacts, including agriculture, food and beverage, manufacturing, and automotive industries. It anticipates several companies to join before its official launch at the WEF Annual Meeting in Davos in January.

Read more: Carpathian Convention adopts vital biodiversity framework on 20th anniversary

Singapore-based exchange Climate Impact X (CIX) will host the pilot auction before Australia's Nature Positive Summit in October 2024. While the voluntary biodiversity market has gained attention in the past year, actual trades remain scarce despite the emergence of various credit standards and projects.

The WEF, in collaboration with McKinsey, aims to demonstrate corporate commitment to funding ecosystem health and building trust between buyers and sellers in the market. This buyers club will pilot transactions to enhance participants' understanding of the market.

Read more: 5 Ways businesses can implement the new Global Biodiversity Framework

Valentini revealed the WEF's plan to engage suppliers through an expression of interest and advanced requests for proposals. An expert panel, composed of academics and specialists, will select projects based on transparency, methodology, and credit packaging. This approach will test the tradability of credits, a significant element the WEF intends to explore.

One major challenge in the biodiversity credit market is determining fair pricing. Different types of credits represent varying ecological values. Valentini emphasised the importance of finding the right price to reward biodiversity rather than simply aiming for the lowest price. This initiative seeks to ensure that biodiversity is duly recognised and incentivised.

DGB Group's commitment to a greener, more sustainable future encompasses a multifaceted approach. Our nature-based initiatives benefit the environment and local communities, revitalising degraded lands, creating wildlife sanctuaries, and fostering biodiversity. We stand ready to support companies, investors, governments, and individuals in making lasting, positive contributions to a more biodiverse world.

Take action for biodiversity conservation