A modern corporate decarbonisation strategy combines internal emissions reductions with carefully structured corporate carbon portfolio design. By integrating high-integrity nature-based credits, companies can manage residual emissions while strengthening ecosystem services, enhancing corporate sustainability reporting, and reinforcing long-term credibility.

Forestry workers planting trees as part of a reforestation project, with the business district of a modern city visible in the background. AI generated picture.

Forestry workers planting trees as part of a reforestation project, with the business district of a modern city visible in the background. AI generated picture.

The era of simple offset purchasing is over. Investors, regulators and customers increasingly expect environmental strategies to demonstrate rigour, transparency, and measurable impact. In this context, carbon credits are strategic assets that must be selected and managed with the same discipline applied to financial portfolios.

Forward-looking companies now approach decarbonisation as a capital allocation exercise. They reduce emissions across operations and supply chains wherever technically and economically feasible. For unavoidable residual emissions, they construct diversified credit portfolios designed to manage cost exposure, supply risk, and reputational integrity over time.

Within this framework, nature-based credits emerge as structural components of a resilient sustainability strategy. Their value extends beyond carbon accounting. They restore ecosystems, protect biodiversity, reinforce natural capital, and generate tangible benefits that can be transparently integrated into corporate sustainability reporting.

Understanding this shift—from offsetting to portfolio engineering—is essential. It reframes nature-based solutions from a short-term bridge to a foundational layer of long-term corporate environmental infrastructure.

This article explores how nature-based credits strengthen a modern corporate decarbonisation strategy through disciplined corporate carbon portfolio design. We examine the strategic role they play in managing residual emissions, the measurable ecosystem services they deliver beyond carbon, the factors that determine their long-term credibility, and how they can be systematically integrated into corporate sustainability reporting and ESG frameworks. Together, these elements reveal why nature-based credits function as core infrastructure within resilient sustainability portfolios.

What is corporate carbon portfolio design?

Corporate carbon portfolio design is the strategic allocation of emissions reduction measures and carbon credits to manage cost, risk, and credibility across a decarbonisation pathway. It balances internal abatement, nature-based credits, and long-term removals to ensure supply stability, regulatory alignment, and long-term climate integrity.

In practice, this represents a shift from opportunistic credit purchasing to structured capital planning. Rather than treating carbon credits as interchangeable commodities, organisations evaluate them by function: duration, co-benefits, liquidity, cost trajectory, verification standards, and alignment with disclosure frameworks.

Green Earth’s nature-based projects.

Green Earth’s nature-based projects.

A robust corporate carbon portfolio design typically rests on three layers.

- First, the foundation of any credible corporate decarbonisation strategy is reducing emissions within a company’s own operations and value chain. Operational efficiency, renewable energy procurement, and process improvements lower long-term costs, reduce regulatory exposure, and strengthen overall risk management.

- Second, high-quality carbon credits address emissions that cannot yet be eliminated. The emphasis is on integrity: additionality, permanence safeguards, rigorous monitoring, and measurable ecosystem services. High-integrity nature-based credits provide structured support for biodiversity, land restoration and community resilience while reinforcing broader sustainability reporting.

- Finally, investing in long-term nature-based solutions strengthens supply chains, builds operational and environmental resilience, and improves stakeholder expectations. By embedding long-term stewardship and governance safeguards, into corporate carbon portfolio design, organisations prepare for evolving regulations and increasing environmental volatility and scrutiny.

When developed and governed with rigour, nature-based carbon assets function as enduring environmental infrastructure, delivering sequestration, biodiversity recovery and systemic resilience over multi-decade horizons.

Read more: Stay in the game: What CSRD means for supplier carbon footprints in 2026

This portfolio approach mirrors financial risk management. Concentration in a single asset class exposes companies to price volatility, supply constraints, and reputational vulnerability. Diversification across credit types, geographies and project structures enhances resilience.

Importantly, corporate carbon portfolio design is not solely about carbon tonnage. It is about aligning environmental action with enterprise risk management, capital allocation discipline, and corporate sustainability reporting requirements. When executed with rigour, it transforms carbon credits from compliance instruments into strategic environmental assets.

What role do nature-based credits play in a corporate decarbonisation strategy?

Within a corporate decarbonisation strategy, nature-based credits address residual emissions while delivering measurable ecosystem services such as biodiversity restoration, soil regeneration, and water resilience. They enhance portfolio flexibility, strengthen corporate sustainability reporting, and reinforce long-term environmental credibility.

Read more: Benchmarking emissions: What’s a good carbon footprint for my industry?

Nature-based credits play a complex role in any portfolio:

- Address unavoidable residual emissions: They enable companies to take responsibility for hard-to-abate emissions while internal reductions continue.

- Deliver verified ecosystem services: They support biodiversity restoration, soil regeneration, watershed protection, and natural capital recovery.

- Strengthen corporate sustainability reporting: They provide quantifiable environmental and social co-benefits aligned with ESG and emerging biodiversity disclosure frameworks.

- Enhance portfolio diversification: They reduce geographic and asset-class concentration risk within carbon credit allocations.

- Reinforce long-term environmental credibility: They demonstrate immediate nature-positive action and a commitment to address corporate footprints.

- Improve stakeholder engagement: They offer tangible, visible projects that resonate with investors, regulators, and customers.

In this context, nature-based credits emerge as structural components that align environmental restoration with ecosystem resilience and long-term enterprise stability.

What are the nature-based solution benefits, beyond carbon?

Nature-based solution benefits extend beyond carbon sequestration to include biodiversity restoration, ecosystem services protection, environmental adaptation, and community resilience. These co-benefits transform nature-based credits from single-metric instruments into multidimensional nature assets.

Read more: Beyond tonnes: How carbon credit co-benefits elevate value

Within a corporate decarbonisation strategy, the most material nature-based solution benefits include:

- Biodiversity restoration: Reforestation, peatland recovery, and regenerative land management rebuild habitats, protect species, and strengthen ecological integrity—outcomes increasingly material under biodiversity disclosure frameworks.

- Enhanced ecosystem services: Healthy forests, wetlands, and soils regulate water cycles, prevent erosion, improve air quality and stabilise local climates. These ecosystem services underpin supply chain continuity and agricultural productivity.

- Climate adaptation resilience: Mangrove restoration reduces coastal flood risk; watershed protection mitigates drought exposure; soil carbon enhancement improves crop resilience. Nature-based projects, therefore, support both mitigation and adaptation objectives.

- Natural capital preservation: By regenerating degraded landscapes, nature-based solutions protect the underlying natural assets upon which many industries depend.

- Community and livelihood support: High-integrity projects engage with local communities, often creating local employment and additional income streams, strengthening land stewardship, and improving long-term socio-economic stability.

Green Earth’s nature-based projects.

Green Earth’s nature-based projects.

These benefits materially enhance corporate sustainability reporting, enabling organisations to demonstrate integrated sustainable action rather than isolated carbon compensation.

In a well-structured corporate carbon portfolio design, nature-based solution benefits therefore embed climate mitigation within ecosystem regeneration, reinforcing both environmental integrity and corporate resilience.

How do ecosystem services strengthen corporate environmental strategy?

Ecosystem services strengthen corporate environmental strategy by protecting the natural systems that underpin supply chains, water security, and long-term operational resilience. Restoring these systems reduces environmental risk while reinforcing emissions management efforts.

Forests regulate rainfall and absorb carbon. Wetlands filter water and reduce flood exposure. Healthy soils improve agricultural productivity. These functions are critical inputs to economic stability, not peripheral environmental concerns.

As ecosystem degradation increases volatility across global value chains, companies face rising exposure to resource scarcity and operational disruption. Integrating high-integrity nature-based credits within a corporate decarbonisation strategy helps restore these systems, strengthening both environmental performance and business resilience.

Read more: Balancing portfolios: Nature-based vs renewable carbon credits

Increasingly, corporate sustainability reporting reflects this broader dependency on natural capital, and why nature-based credits are important for ESG reporting. Supporting ecosystem services, therefore enhances not only emissions outcomes but also long-term strategic positioning.

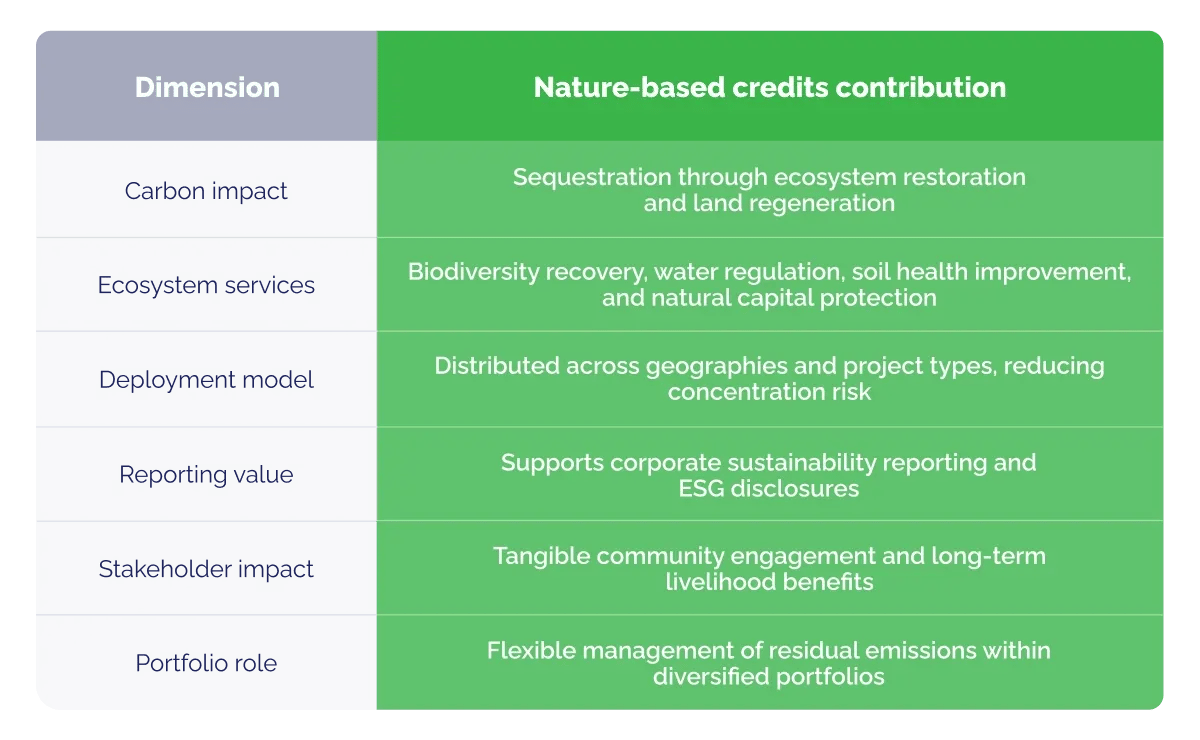

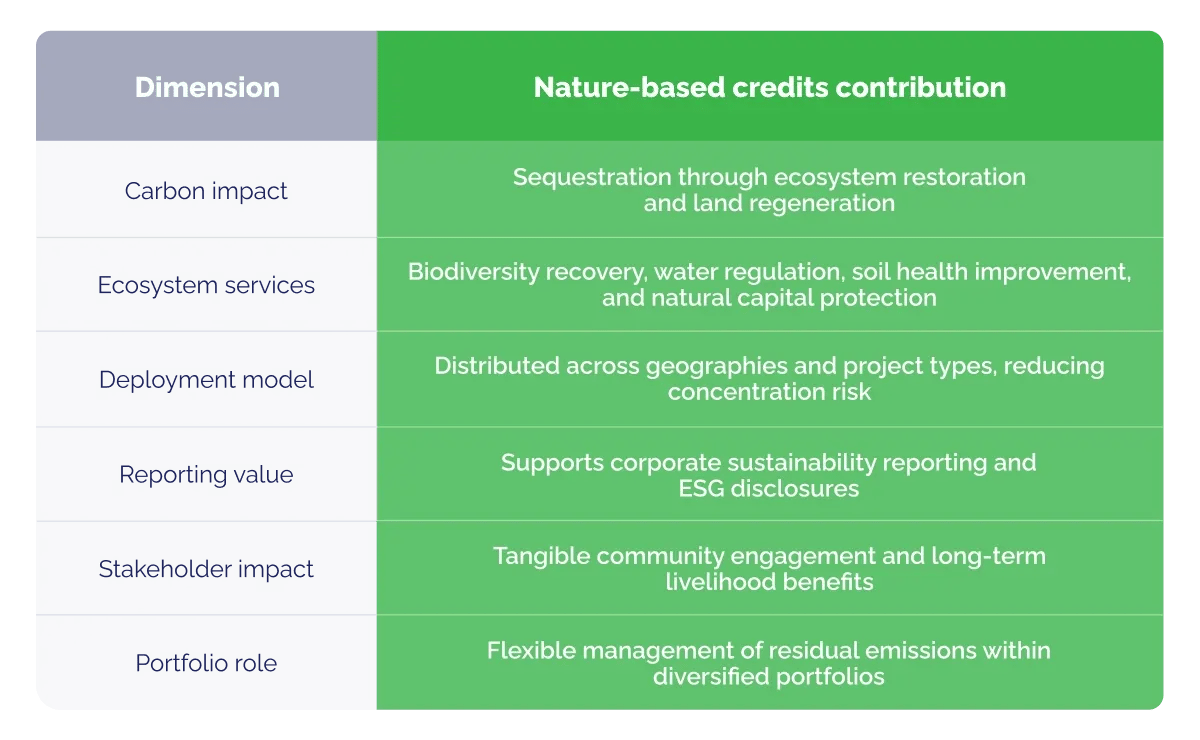

Key characteristics of nature-based credits in corporate carbon portfolio design

In structured corporate carbon portfolio design, nature-based credits contribute multidimensional value that extends beyond emissions accounting. Their characteristics make them uniquely suited to strengthening resilience, reporting integrity, and long-term portfolio stability.

The table below summarises their strategic contribution within a modern corporate decarbonisation strategy.

What determines the long-term credibility of nature-based carbon credits?

The long-term credibility of nature-based carbon credits depends on additionality, permanence safeguards, rigorous monitoring, and transparent governance. High-quality projects are designed to withstand environmental, regulatory, and market scrutiny over multi-decade horizons.

Credibility begins with clear additionality—demonstrating that the carbon sequestration would not have occurred without the project. It is reinforced through permanence mechanisms such as buffer pools, legal protections, and long-term land management commitments.

Advanced monitoring, reporting and verification (MRV) systems, including satellite tracking and third-party audits, further strengthen integrity. Transparent governance structures and community engagement through on-the-ground presence reduce reversal risk and enhance accountability.

Read more: How to choose high-quality carbon credits

When these safeguards are embedded from the outset, nature-based credits provide durable, defensible value within a structured corporate decarbonisation strategy.

How to integrate nature credits into corporate strategy, and why they are important for ESG reporting

Integrating nature credits into corporate strategy requires deliberate alignment between emissions management, risk governance, and disclosure frameworks. When structured correctly, nature-based credits strengthen both operational resilience and corporate sustainability reporting.

The first step in understanding how to integrate nature credits into corporate strategy is to quantify residual emissions after internal reduction measures would be implemented. Nature-based credits should address unavoidable emissions within a clearly defined corporate decarbonisation strategy, not serve as a substitute for operational abatement.

Second, organisations must embed credits within formal corporate carbon portfolio design. This involves selecting high-integrity projects from trusted developers that deliver verified ecosystem services, have a local presence to ensure long-term project success, and who incorporate permanence safeguards.

Third, governance integration is essential. Nature-based investments should be connected to procurement, risk management, and sustainability teams to ensure transparency and accountability. This is an ongoing process involving continuous evaluations and alignment.

Designing a resilient corporate decarbonisation strategy for the long term

A resilient corporate decarbonisation strategy does more than manage residual emissions. It supports nature, people, and your business. Nature-based credits, when developed and governed with integrity, become foundational assets within structured corporate sustainability portfolio design.

The strength of any portfolio, however, depends on the quality of its underlying projects.

Green Earth operates as an end-to-end developer of large-scale nature-based solutions accredited by leading third parties. We restore ecosystems, protect biodiversity, and support communities worldwide, enabling businesses, governments, and institutions to meet their net-zero objectives through high-integrity carbon credits.

Green Earth’s nature-based projects.

Green Earth’s nature-based projects.

Our boots-on-the-ground model distinguishes us within the market. We oversee every stage of the project lifecycle—from development and implementation to long-term operation and carbon credit sales. This integrated approach ensures measurable outcomes, transparent governance, and durable permanence safeguards. It also strengthens the long-term credibility of our nature-based carbon credits, a factor increasingly scrutinised within ESG and regulatory frameworks.

By combining ecological science, data intelligence and commercial expertise, we design projects that deliver environmental and socio-economic benefits across international markets, reinforcing why nature-based credits are important for ESG reporting and long-term environmental strategy.

For organisations seeking to integrate nature credits into corporate strategy with confidence, the difference lies in working with developers who ensure quality from the ground up.

If your organisation is refining its corporate carbon portfolio design and looking to secure high-integrity nature-based credits, Green Earth provides the expertise, governance, and global project access to support your long-term objectives.

Explore our carbon credit portfolio and discover how nature can strengthen your decarbonisation strategy.

Forestry workers planting trees as part of a reforestation project, with the business district of a modern city visible in the background. AI generated picture.

Forestry workers planting trees as part of a reforestation project, with the business district of a modern city visible in the background. AI generated picture.