For SMEs operating within European value chains, CO₂ reporting has evolved from a voluntary transparency exercise into a critical operational requirement. While the direct legal mandates of the Corporate Sustainability Reporting Directive (CSRD) primarily target larger entities, the administrative burden has shifted downstream.

Employees of a small business working in an office. AI generated picture.

Employees of a small business working in an office. AI generated picture.

As of 2026, the challenge for SMEs is producing audit-ready, European Sustainability Reporting Standards (ESRS)-aligned data that satisfies the rigorous procurement standards of enterprise-level clients and the Environmental, Social, and Governance (ESG) scoring of financial institutions.

Larger partners' legal obligations drive this urgency for SMEs. Under CSRD, large corporations are mandated to report on their Scope 3 (value chain) emissions. This creates a non-negotiable data request for their suppliers. Recent market data from OECD’s Global Corporate Sustainability Report 2025 indicates that 91% of listed companies worldwide are already reporting on sustainability targets, and their focus has shifted to the detailed verification of supplier inputs.

Most organisations approach emissions accounting as part of their ESG management with a legacy mindset, either deferring action until a client’s data request becomes a crisis or over-investing in one-off, non-scalable consulting retainers. To bridge this gap, we propose a hybrid methodology that integrates emissions accounting directly into existing financial and operational workflows rather than treating it as a resource-heavy silo.

This approach leverages automation to handle the high-volume data collection and calculation required by ESRS standards, while utilising targeted expert review to navigate the technical nuances of boundary-setting and materiality. The result is CSRD compliance without an internal ESG team: a streamlined, audit-ready process that scales with the business without inflating its headcount.

In this article, we break down how your business can meet these expectations while keeping your headcount the same. We begin by clarifying the four core technical requirements of the ESRS E1 and VSME standards to help you avoid over-reporting. We analyse the operational shift from manual tracking to a hybrid methodology: a model that combines automation with targeted expert oversight. And we will demonstrate how Green Earth’s CO₂ Expert tool provides a turnkey architecture to handle emissions accounting, allowing you to deliver verified reports while keeping your internal resources focused on your core business.

The four requirements: Technical emissions foundations for ESG management for SMEs

To implement efficient emissions accounting as part of ESG management for SMEs, you must first strip away the complexity of enterprise-level frameworks and focus on the technical requirements that directly impact your compliance status and commercial viability. In the 2026 reporting landscape, this means mastering four specific pillars.

1. Scope 1, 2, and 3: Defining the boundaries

The backbone of any environmental disclosure is the quantification of greenhouse gas emissions.

- Scope 1 (Direct): Emissions from sources you own or control (eg, company vehicles, onsite boilers).

- Scope 2 (Indirect - energy): Emissions from the generation of electricity, steam, or heat you purchase.

- Scope 3 (Value chain): Indirect emissions representing over 70% (or even more than 90%) of a company's footprint, this includes everything from raw material extraction to product end-of-life.

For SMEs, the challenge is not just identifying these scopes, but performing emissions accounting with high data quality to withstand a third-party audit.

Read more: Benchmarking emissions: What’s a good carbon footprint for my industry?

2. The VSME Standard: The simplified path

Recognising that the full ESRS is too heavy for smaller teams, the European Financial Reporting Advisory Group (EFRAG) has finalised the Voluntary SME (VSME) standard. This modular framework allows non-listed SMEs to report using a simplified Basic Module—focusing on 11 core disclosures rather than the 80+ required for larger firms. It serves as the primary ‘common language’ for providing data to banks and enterprise customers without the administrative burden.

Read more: The VSME Standard for SMEs: Simplified ESG reporting in the EU

3. Double materiality: The strategic filter

Double materiality is the principle of assessing sustainability from two lenses:

- Impact materiality: How your business affects the environment (eg, carbon output).

- Financial materiality: How environmental risks affect your business (eg, rising energy costs or supply chain disruptions).

By conducting a targeted materiality assessment, SMEs can legally omit disclosures that are not relevant to their operations, preventing over-reporting that often paralyses small teams.

4. Audit-ready data quality

The final requirement is the shift from ‘best-guess’ estimates to verifiable data. As SMEs account for 40% to 60% of all business-sector greenhouse gas emissions globally, regulators and auditors no longer accept fragmented spreadsheets. Compliance now requires a ‘digital trail’ of evidence that links every emissions factor to its primary source.

Read more: CSRD for SME Suppliers: How to turn data requests into a competitive advantage

The strategic transition: From admin burden to automated leadership

The primary friction point for most companies is a legacy mindset that treats sustainability as a one-off audit project. This typically results in a Consultant Trap—spending thousands on manual reports that offer zero long-term data maturity. To achieve cost-effective carbon accounting, SMEs must pivot to a system that prioritises efficiency over manual labour.

The architecture of modern compliance

We address this gap through a three-pillared system that replaces the need for an expensive, full-time ESG team. By integrating these capabilities, your business moves towards a hybrid model where technology handles the volume and people handle the strategy:

- Data autonomy: Instead of chasing utility bills across departments, a modern system centralises data ingestion, mapping raw inputs directly to verified emission factors (GHG Protocol).

- Structural alignment: The system logic is pre-configured to the VSME and ESRS standards. This ensures that your output isn't just a number, but a structured disclosure that your clients can plug directly into their own Scope 3 audits.

- Expert oversight: By utilising a human-in-the-loop model, you gain the security of an outsourced ESG coordinator who validates the final data, ensuring it is audit-ready without the six-figure salary of a permanent hire.

The goal of this architecture is simple: to make emissions accounting a background process. This transition ensures that when a bank or a major client asks for your data, you aren't starting from scratch—you simply hit download.

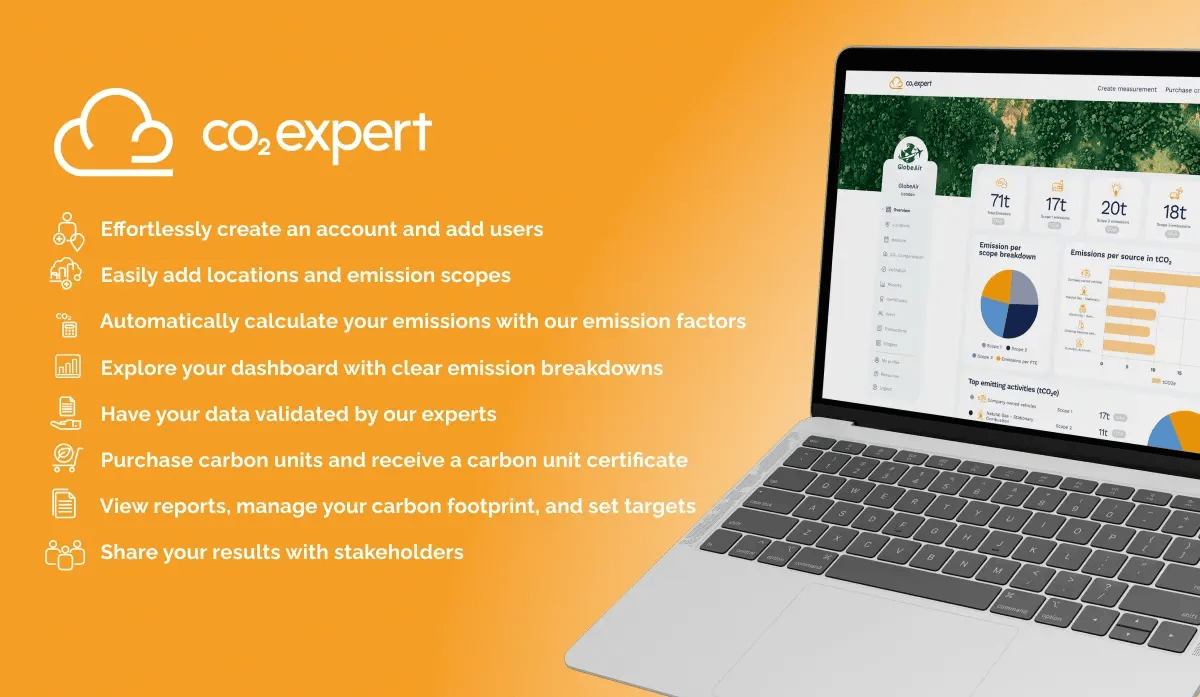

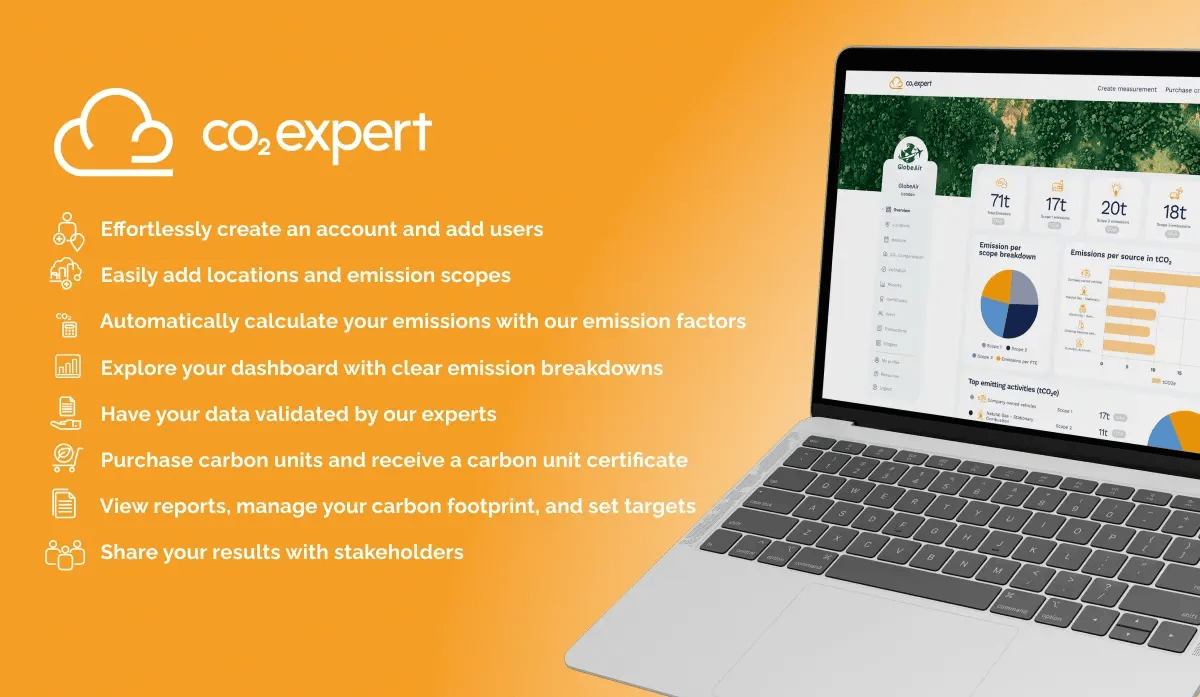

Step-by-step: Lean reporting with the CO₂ Expert tool

While many businesses still struggle with rough estimates and fragmented spreadsheets, the Green Earth CO₂ Expert tool was engineered specifically to bridge the SME resource gap. It is the practical execution of the hybrid model, designed to move you through the CSRD 12-month plan with precision and ease.

With the 2026 enforcement window closing, the tool provides a turnkey solution for how to automate ESRS for SMEs through a streamlined, multi-user interface.

How the CO₂ Expert tool drives compliance

Our tool goes beyond broad industry averages to measure your actual emissions across all activities, providing the audit-ready status required for modern supply chains:

- Emissions accounting automation: Create an account, invite collaborators, and let the tool’s built-in emission factors deliver fast, precise results across Scope 1, 2, and 3.

- Intuitive dashboards: Move away from ‘black box’ reporting. Our dashboards highlight exactly where your emissions originate, allowing you to identify cost-saving inefficiencies in real-time.

- Expert validation: To ensure your data stands up to third-party scrutiny, our specialists review your inputs, providing the credibility needed for CSRD compliance.

- Audit-ready output: Download detailed carbon footprint reports and ready-to-use communication materials designed specifically for investors, clients, and banks.

- Integrated decarbonisation: If you need to address hard-to-abate emissions, the tool allows you to purchase high-integrity carbon credits and receive certificates to share with stakeholders.

By leveraging the CO₂ Expert tool, you move from a reactive posture to a leadership position. You get the accuracy of a dedicated ESG department through a streamlined, efficient tool.

Strategic benefits: Moving beyond the checklist

Focusing on CSRD merely as a legal hurdle misses the broader operational opportunity. When emissions accounting is integrated into your business logic rather than treated as a year-end chore, the data starts working for you.

Read more: Carbon footprint offsetting strategies: How leading companies neutralise their emissions

Beyond satisfying a regulator, a lean reporting model offers three distinct commercial advantages:

- Procurement priority: Large enterprises are actively pruning their supply chains to remove ‘high-carbon’ risks. Having a verified, audit-ready footprint makes your business the ideal choice for procurement officers.

- Operational savings: The process of mapping Scope 1 and 2 emissions almost always exposes energy waste. By identifying these hotspots through the CO₂ Expert tool, companies often find direct routes to lower utility and fuel costs.

- Capital access: Banks and investors are increasingly tying interest rates and credit approvals to sustainability performance. A professional-grade report is now a prerequisite for favourable financing terms in 2026.

Two office employees analyzing the company’s data. AI generated picture.

Two office employees analyzing the company’s data. AI generated picture.

Your next step: Start small, scale smart

The window for preparation is effectively over. As we move into the enforcement phase of CSRD, the advantage lies with SMEs that can provide transparent, verified data without draining their internal resources. You don’t need to build a new department or hire a fleet of consultants to secure your market position; you simply need a system that handles the complexity for you.

By adopting the CO₂ Expert tool and combining automated data ingestion with targeted expert validation, you ensure your business remains compliant, credible, and competitive. Ready to set up your sustainability strategy? Stop managing spreadsheets and start managing your targets.