DGB Group N.V. (“DGB” or “the Group”) (Euronext: DGB: NL0009169515), a leading carbon project developer and ecosystem restoration company, issues its outlook of expected carbon credit issuance from project operations for the coming years. The Group has upgraded its outlook positively with a substantial increase in its carbon credit inventory to an expected 60.1 million carbon credits in its pipeline.

DGB is a purpose-driven project developer specialising in nature-based solutions, managing high-quality projects that emphasise ecosystem restoration, conservation, and biodiversity enrichment. Through its projects, products, and services, DGB aids companies in understanding and committing to environmental improvement, assessing and offsetting their environmental footprint, developing strategies for environmental solutions, and communicating their progress on sustainability transparently.

DGB’s boots-on-the-ground approach enables it to deliver high-quality, verified carbon credits (“carbon credits”) for significant positive environmental impact. Carbon markets are rapidly expanding. There is near-universal consensus from governments and private companies that the market needs to grow to match global net-zero needs.

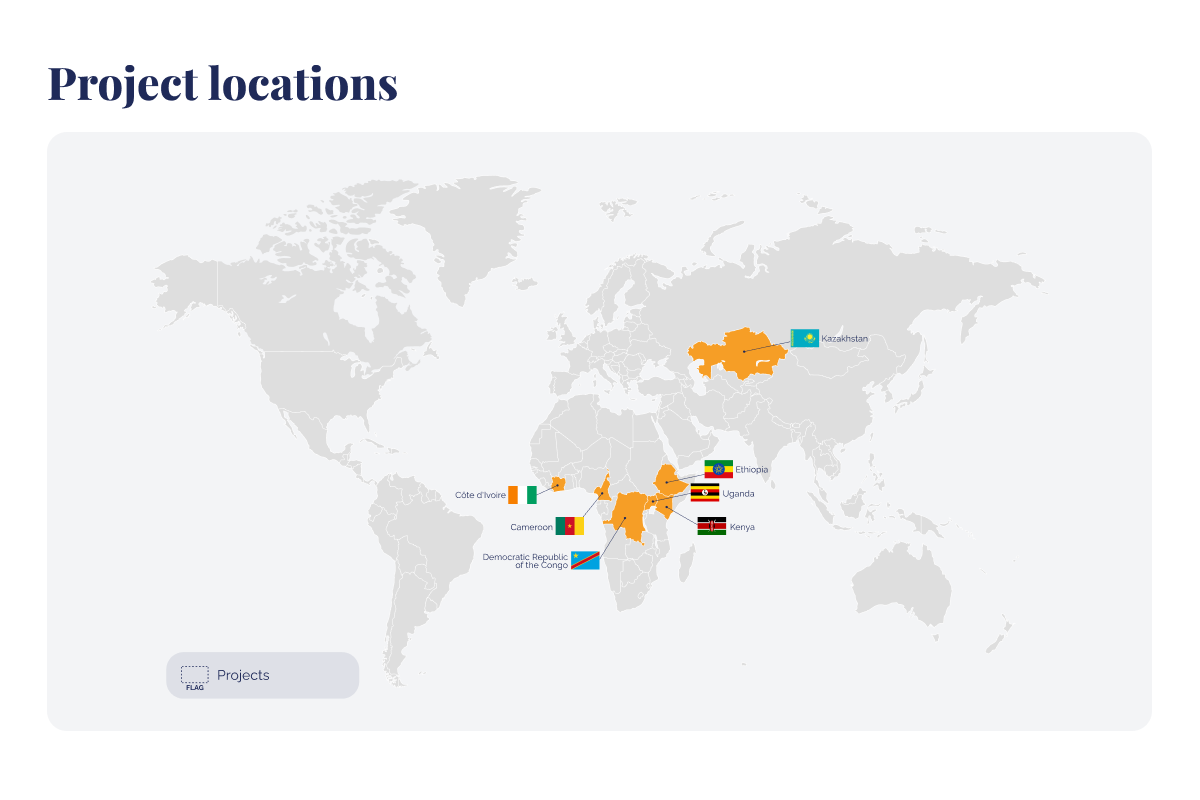

In 2020, DGB started with its first project and now has seven large-scale projects under management and in operation. The operational team is conducting preliminary studies on 12 more projects. Projects need two to six years of financing before they start producing carbon credits.

In 2023, the Group expanded its project development pipeline to 60.1 million carbon credits under management, marking a substantial +58% year-over-year growth.

Complementing this growth, DGB has strategically diversified its project pipeline, venturing into new domains with the inclusion of plastic and biodiversity credits through new projects and methodologies. This strategic diversification into new project types marks a pivotal step in its ongoing commitment to environmental innovation, sustainability, and diversified revenue streams.

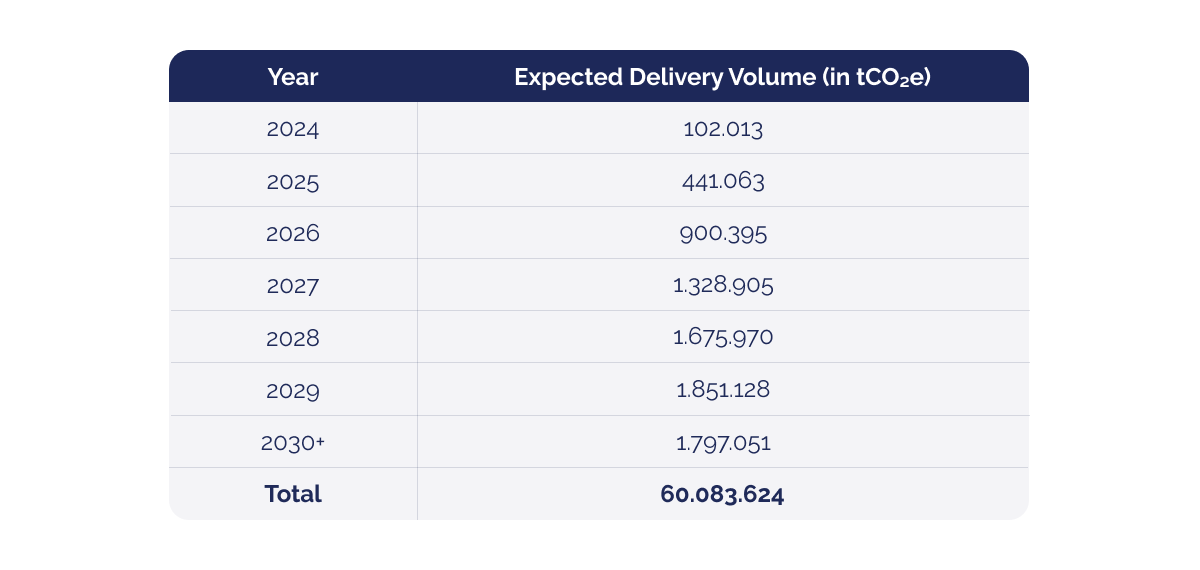

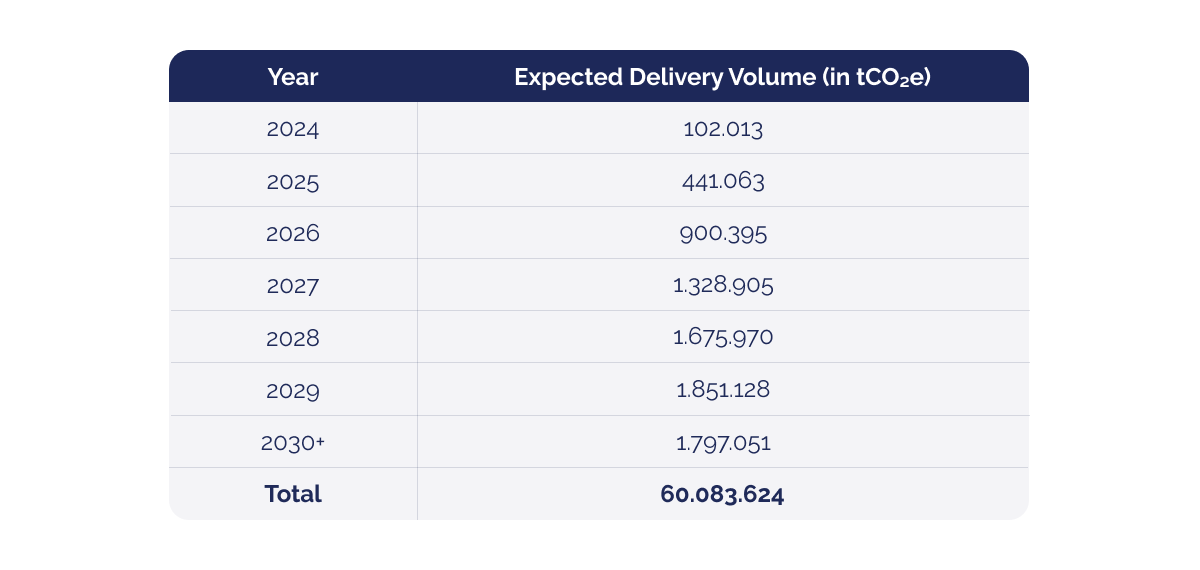

The Group bases its outlook on its current (carbon) project pipeline. The anticipated issuance profile for carbon credits from our projects currently under development is as follows:

DGB expects 60.1 million carbon credits over the lifetime of its project pipeline. Exact issuance profiles per project are provided upon request to buyers and project financiers.

Carbon credit price outlook

The outlook is based on currently available project documentation, the phase and status of the projects, and the carbon credit generation projections.

For valuation, DGB prices anticipated carbon credits on current market transactions, working with an illustrative sale price of $10.00 per credit for a cookstove project, $11.00 per credit for a REDD+ project, and $18.00 per credit for an AR project.

The Board of Directors foresees a price increment in accordance with the outlook of the EY Net Zero Centre. It forecasts a verified emission reduction price rise of 9.5% to 15.0% per year towards 2035 and a 4.0% to 6.0% price increase from 2035 to 2050. DGB’s projection aligns with previously issued price expectations and remains conservative when juxtaposed with forecasts from leading industry analysts.

EY, McKinsey, and BCG, alongside Morgan Stanley, which all anticipate a multi-fold expansion, suggest a market value ranging from $30 billion to $50 billion by 2030. The more optimistic outlooks from Goldman Sachs and Wood Mackenzie forecast a market size of $100 billion by 2030, indicating potential for exponential growth if the right conditions and commitments persist. A conservative projection comes from PwC, estimating growth of up to $30 billion by the same year—still a 10-fold growth compared to today’s $3 billion market. The consensus across all price predictions is the rapid and substantial growth of the market, marking it as a promising long-term investment opportunity.

For clarity, all carbon credit prices are only illustrative, and the price of carbon credits on the market may be higher or lower at the time of sale.

Project finance

DGB funds its operations and projects through the issuance of green bonds, attracting environmentally conscious investors. Additionally, DGB offers forward credits at discounted rates, a move designed to underwrite the ongoing development of its pipeline. The Board of Directors is actively evaluating a range of other innovative financing options to further bolster DGB’s project development capabilities.

CEO Duijvestijn stated: “We contiune building and expanding our portfolio. With the +58% growth in our project pipeline, DGB is strategically positioned to capitalise on the anticipated market trends. Considering the future carbon credit price expectations set by leading analysts, we are not merely observing an upward trajectory in value; we are actively participating in a market poised for significant expansion. Our project pipeline positions DGB to leverage these trends, ensuring that our projects contribute not only to environmental sustainability but also to robust financial returns for our investors. After four years of design, development, and investment in our project pipeline, we are eager to see 2024 become our first revenue-generating year now that the first carbon credits of the pipeline will be issued this year.”

Contact details

DGB GROUP NV

press@dgb.earth

+31320788118

About DGB

DGB is a project developer of high-quality, large-scale carbon and biodiversity projects accredited by third parties. The Group is focused on nature conservation and helping biodiversity flourish by assisting governments and corporations in achieving net zero. Global megatrends drive the demand for carbon credits and underpin growth opportunities. DGB GROUP NV is a public company traded on the main Dutch stock exchange Euronext Amsterdam under the ticker symbol AEX:DGB and ISIN-code NL0009169515. www.green.earth

Disclaimer

This press release does not contain an (invitation to make an) offer to buy or sell or otherwise acquire or subscribe to shares in DGB and is not an advice or recommendation to take or refrain from taking any action. This press release contains statements that could be construed as forward-looking statements, including about the financial position of DGB, the results it achieved and the business(es) it runs. Forward-looking statements are all statements that do not relate to historical facts. These statements are based on information currently available and forecasts and estimates made by DGB’s management. Although DGB believes that these statements are based on reasonable assumptions, it cannot guarantee that the ultimate results will not differ materially from those statements that could be construed as forward-looking statements. Factors that may lead to or contribute to differences in current expectations include, but are not limited to: developments in legislation, technology, tax, regulation, stock market price fluctuations, legal proceedings, regulatory investigations, competitive relationships and general economic conditions. These and other factors, risks and uncertainties that may affect any forward-looking statement or the actual results of DGB are discussed in the annual report. The forward-looking statements in this document speak only as of the date of this document. Subject to any legal obligation, DGB assumes no obligation or responsibility to update the forward-looking statements contained in this document, whether related to new information, future events or otherwise.