DGB Group N.V. (“DGB”, “the Group”, or “the Company”) (Euronext: DGB: NL000916951), a leading carbon project developer and ecosystem restoration company, publishes its quarterly outlook of the verified carbon market (“VCM”). The VCM continues to evolve, demonstrating resilience, adaptability, and a steadfast commitment to environmental sustainability. Following a pivotal year of transitions and significant growth, the VCM stands on the cusp of a new era characterised by innovation, diversity, and a deeper integration of quality and integrity into carbon trading practices.

Key highlights of the VCM’s outlook

- Strong start to 2024: The market for voluntary carbon credits (carbon units) saw an unprecedented increase, reaching a new high of 52.9 million tonnes in Q1—a 20% rise from the previous year. The overall retirement volume for the quarter was significantly higher, recording a 20% year-over-year growth. This quarter's figures were the second highest ever recorded, narrowly trailing behind the final quarter of 2023.

- Transition to the Paris Agreement's Article 6: 2023 marked a significant transition for the VCM, moving from the Kyoto Protocol's frameworks to the more inclusive and dynamic mechanisms of the Paris Agreement’s Article 6, setting the stage for a new era of carbon trading.

- Increased investment: Investments in carbon credit projects have increased, with $36 billion allocated to over 7,000 projects from 2012 to 2022 and $17 billion invested between 2021 and 2023. This increased investment reflects the corporate world's escalating commitment to carbon offsetting as a means to achieve their targets.

- Diversification and diversity surge: The VCM witnessed an increased diversity of buyers, including a record number of first-time participants from various industries, demonstrating a broadening interest and commitment to environmental sustainability across various sectors. In response, developers are expanding their portfolios, diversifying into nature-based solutions, renewable energy, and more.

- Two-track market evolution: Developers in the VCM are navigating a two-track evolution, with some rapidly aligning with new stringent standards (fast track) and others taking a more gradual approach (steady track). This highlights a market rich in opportunities and challenges.

- Projected market growth: The VCM's value is expected to expand to between $10 billion and $40 billion by 2030, with credits adhering to the Core Carbon Principles (CCP) and the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) criteria poised to command a premium due to their higher quality and compliance.

- Heightened demand for nature-based credits: The market is seeing a surge in demand for nature-based carbon credits, which is expected to outstrip supply. Notably, nature-based removal credits have gained value due to their scarcity and the market's growing preference for projects that effectively remove carbon emissions. This heightened demand underscores the market's evolving preferences, with an increasing value placed on high-quality, impactful projects.

- Increased focus on biodiversity: A surge in corporate commitments to biodiversity and the integration of carbon crediting with biodiversity initiatives is anticipated, reflecting the growing recognition of the interconnectedness of environmental action and biodiversity preservation.

- Demand for high-quality credits: The demand for high-quality, verifiable credits that deliver tangible environmental and social benefits is shaping market dynamics, encouraging developers to innovate and adhere to higher standards of project development and reporting.

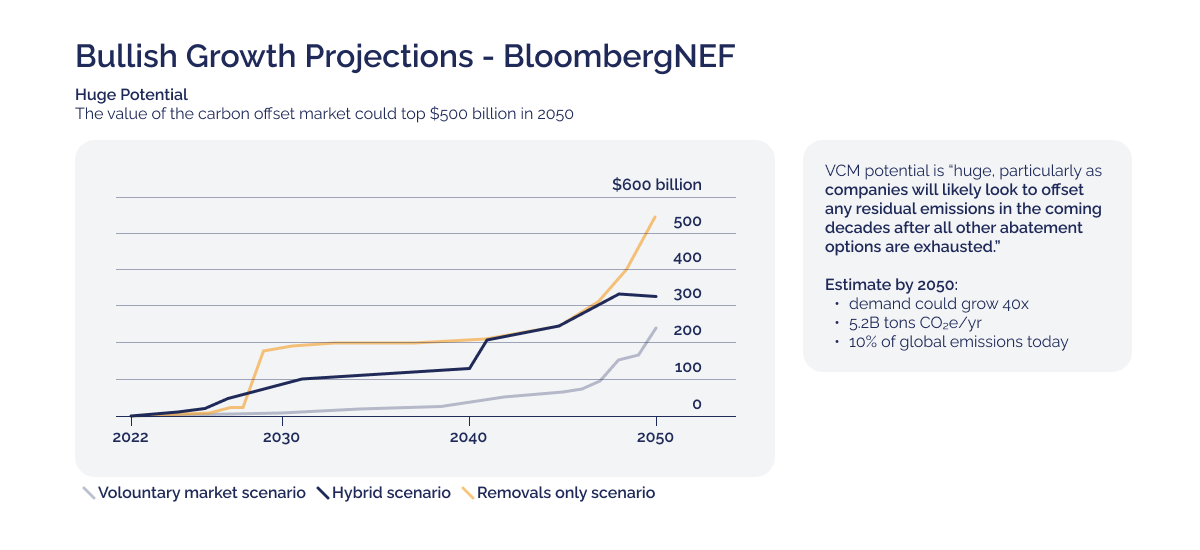

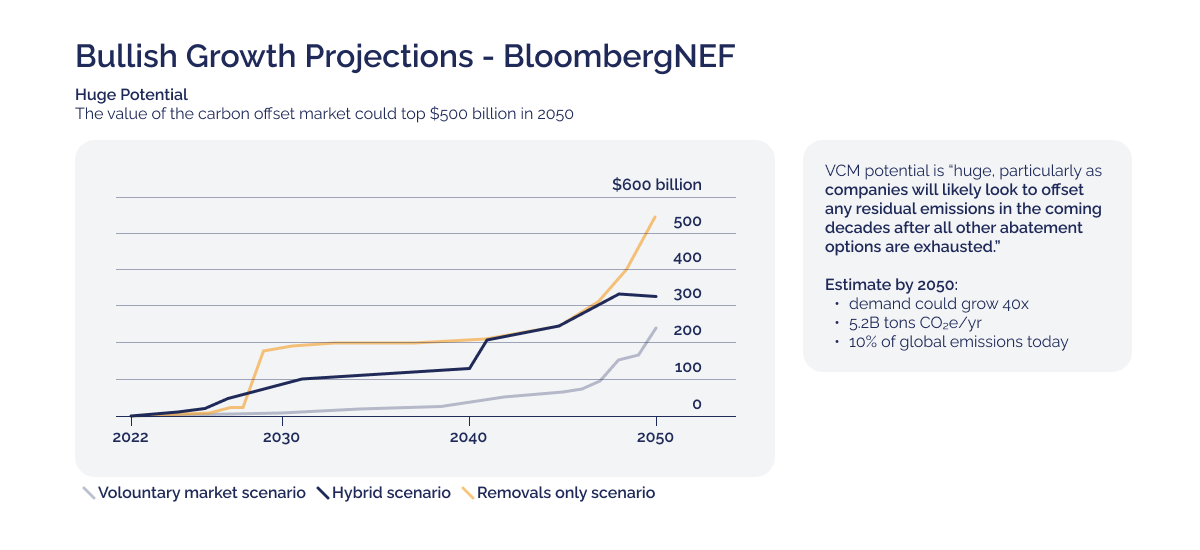

The demand for the VCM is projected to grow up to $500 billion in 2050, according to Bloomberg:

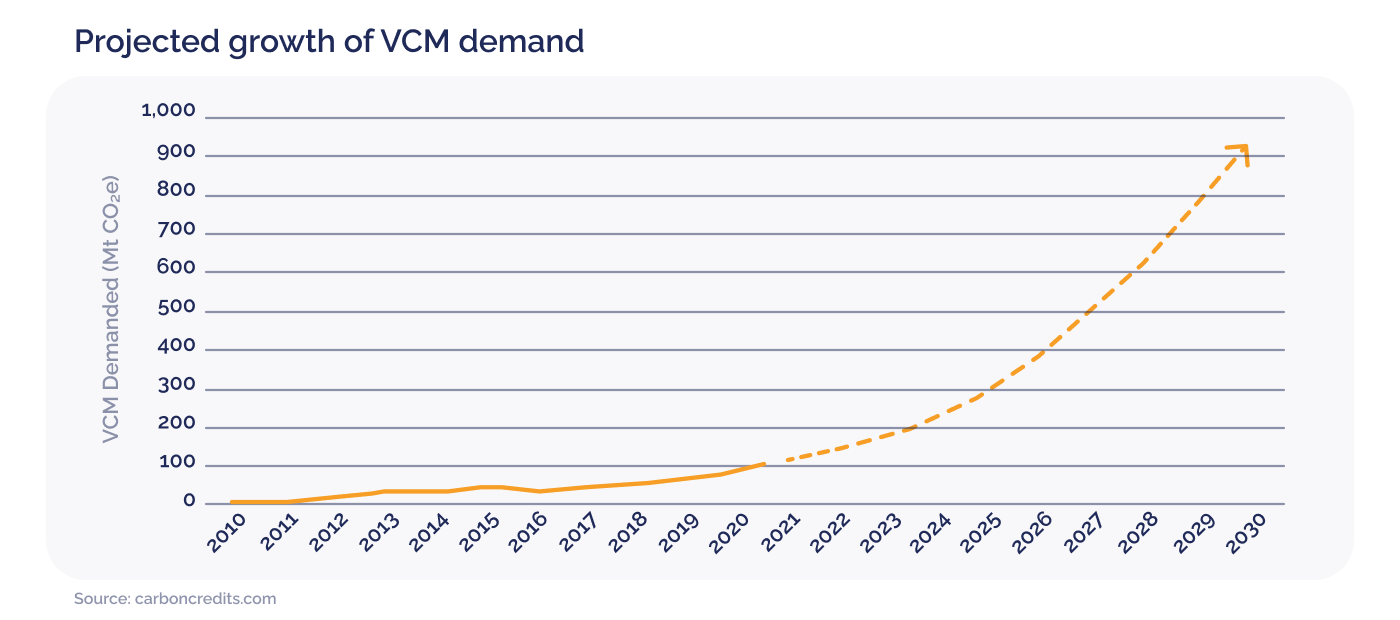

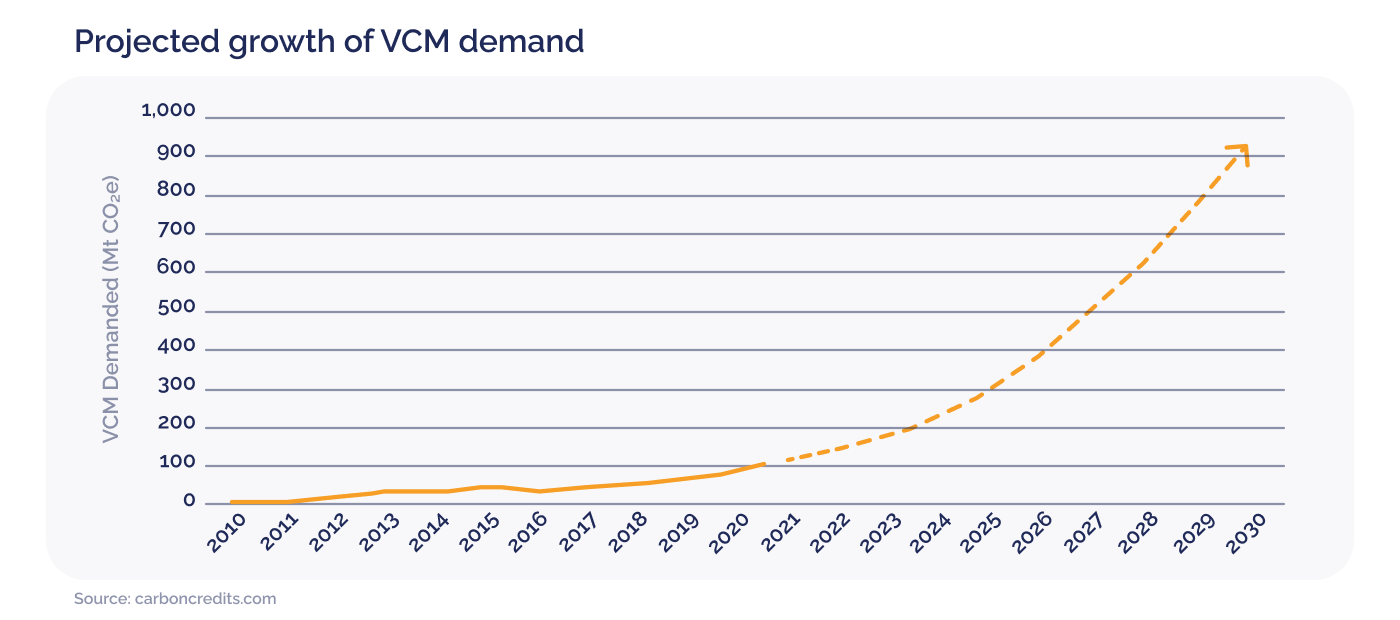

The growth of the VCM is based on the demand for carbon credits:

More and more large multinationals are using carbon credits to offset emissions:

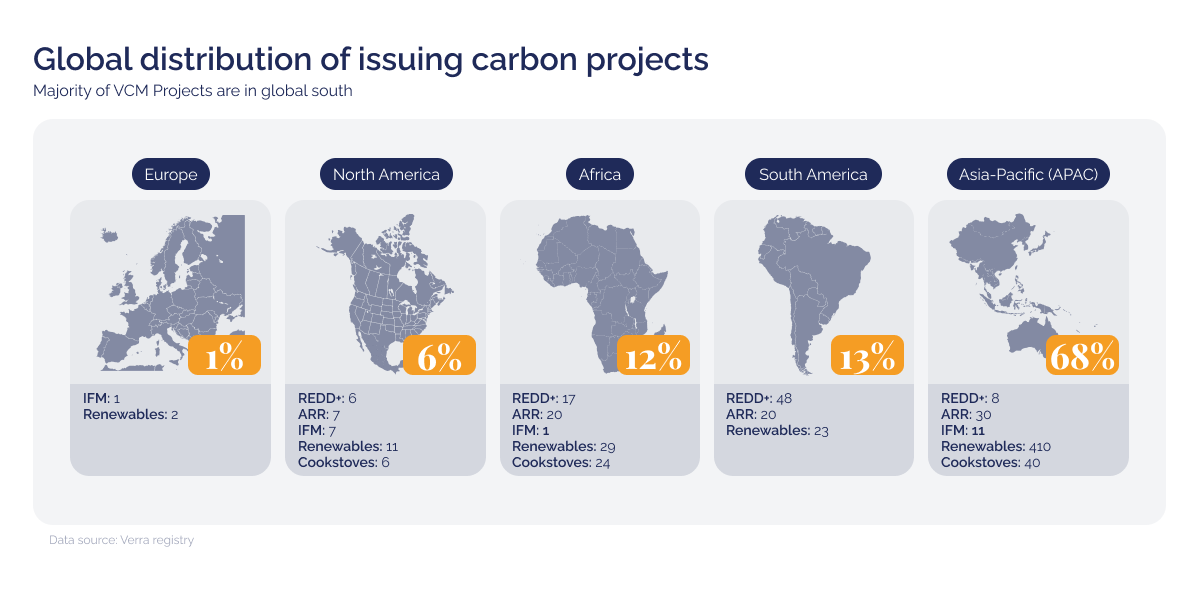

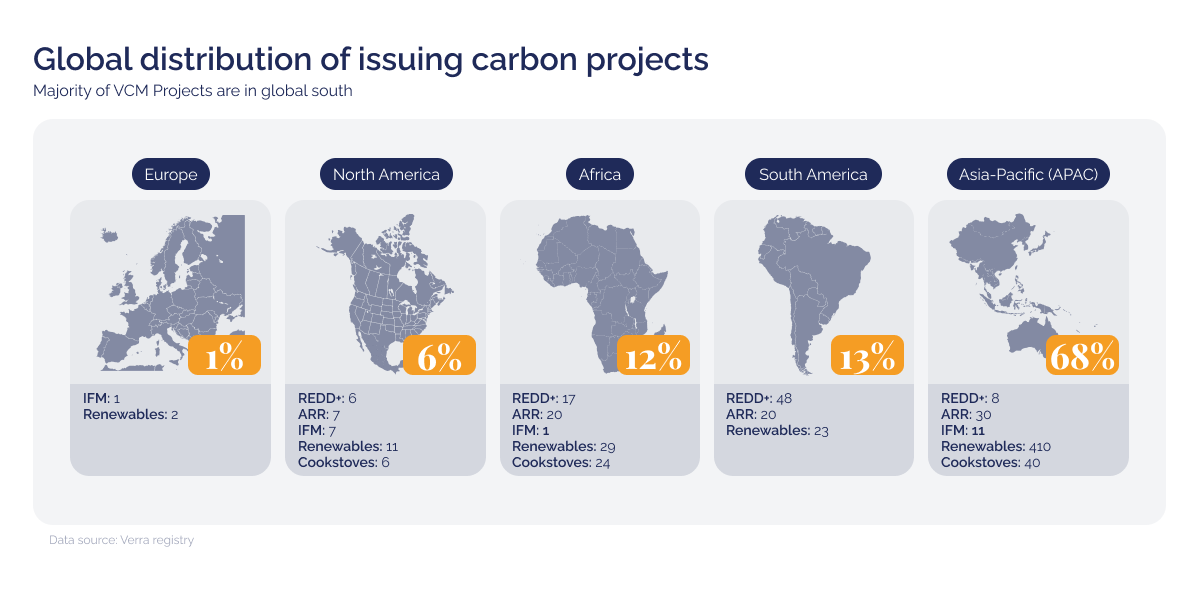

Most projects are developed in South-East Asia. Africa only accounts for 12% of all projects, positioning DGB as a leader in this region:

There are 170 types of carbon credits. DGB specialises in Afforestation/Reforestation/Revegetation and Agroforestry, a niche area:

The number of buyers increased in 2023 for the sixth year in a row. The average retirement volume drops, meaning more smaller companies are entering the market—emphasising the broader acceptance of the markets:

_visual%206.png?width=1800&height=1200&name=Number%20of%20buyers%20and%20average%20retirement%20volume%20per%20buyer%20(2018-2023)_visual%206.png)

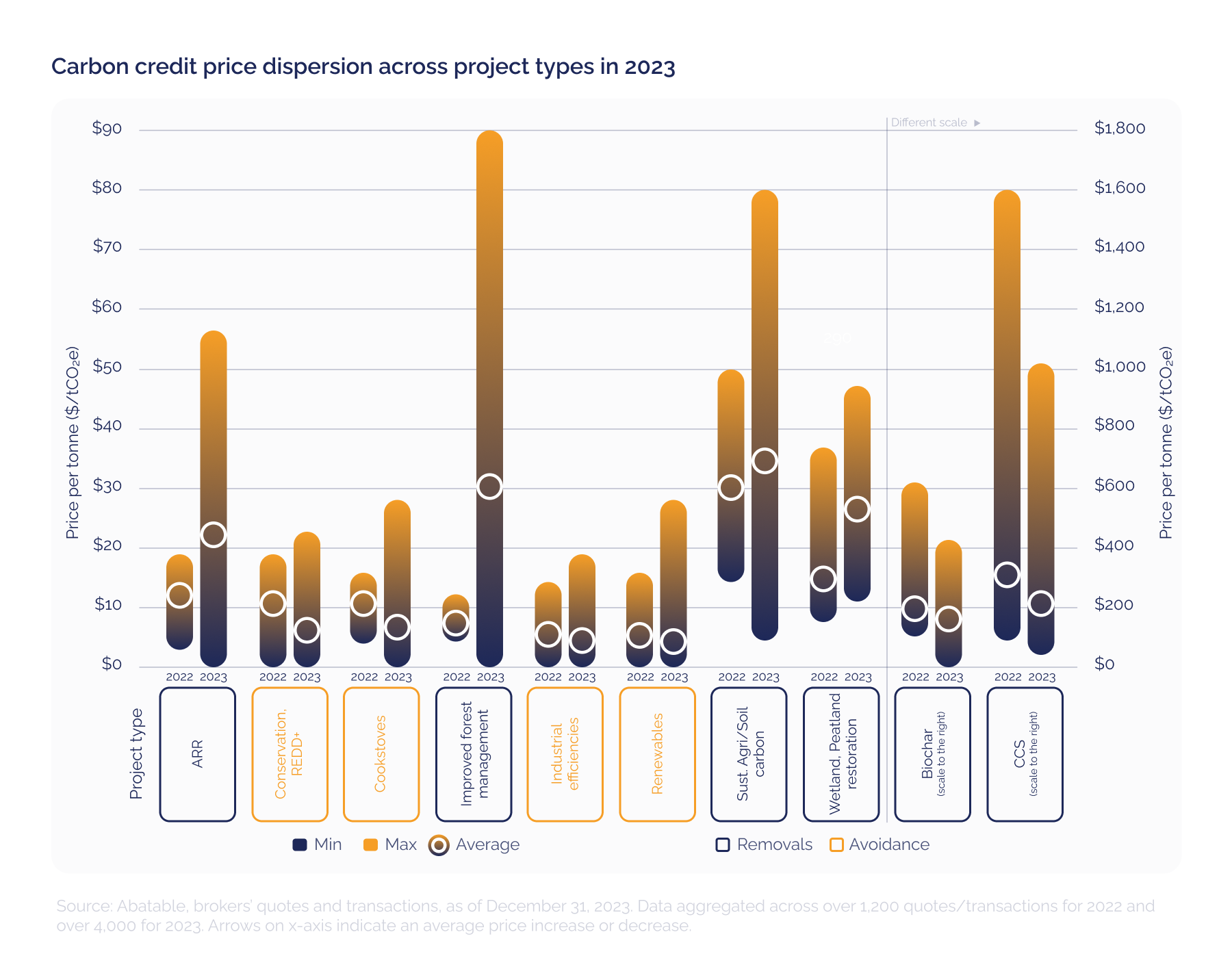

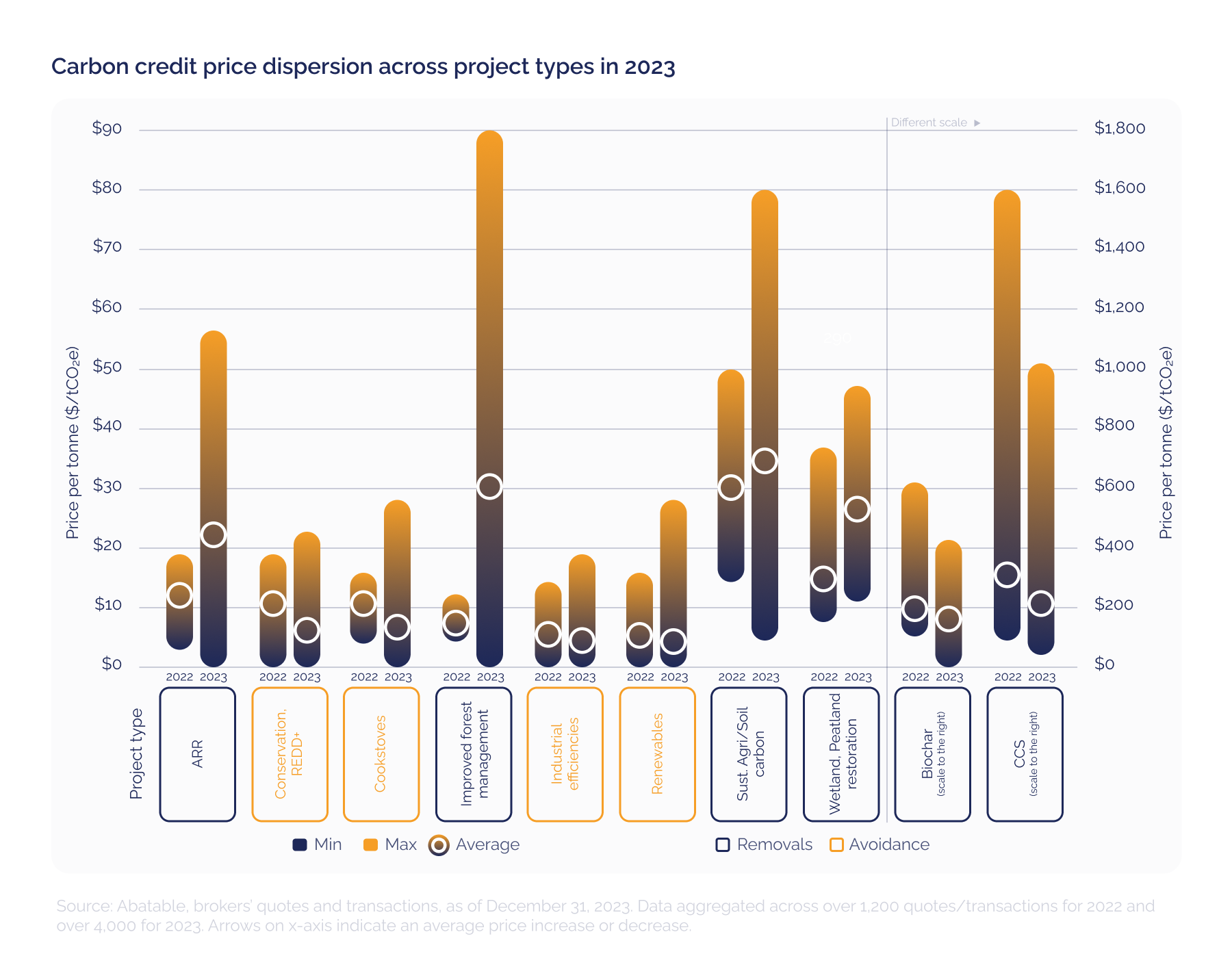

Carbon credit prices differ widely, even among similar project types. There remains a price premium for high-quality credits and a discount for lower-quality credits:

The yearly issuances were again lower in 2023, and the retirements were higher:

_visual%208.png?width=1800&height=1200&name=Yearly%20issuances%2c%20retirements%20and%20historical%20cumulative%20surplus%20(2017-2023)_visual%208.png)

"As we stand at the precipice of an unprecedented expansion within the verified carbon market, projected to reach a valuation between $10 billion and $40 billion by 2030, our expectations for the market's growth and the anticipated rise in carbon credit prices are not just optimistic, but grounded in the tangible progress we've witnessed. This growth and rise in demand for quality carbon credits is a testament to the market's vital role in driving forward our global environmental goals, underpinned by a steadfast commitment to quality, integrity, and innovation. We are poised to navigate this growth and demand, ensuring that the VCM continues to serve as a pivotal force in the collective pursuit of a sustainable and resilient future." - CEO Selwyn Duijvestijn

For more information on the verified carbon market, please visit our newsroom and blog page or subscribe to our newsletter.

Contact for press enquiries

For more information about DGB's initiatives, please contact:

DGB GROUP NV

press@green.earth

+31320788118

Visit our website: https://www.green.earth/

Disclaimer

This press release does not contain an (invitation to make an) offer to buy or sell or otherwise acquire or subscribe to shares in DGB and is not an advice or recommendation to take or refrain from taking any action. This press release contains statements that could be construed as forward-looking statements, including about the financial position of DGB, the results it achieved and the business(es) it runs. Forward-looking statements are all statements that do not relate to historical facts. These statements are based on information currently available and forecasts and estimates made by DGB’s management. Although DGB believes that these statements are based on reasonable assumptions, it cannot guarantee that the ultimate results will not differ materially from those statements that could be construed as forward-looking statements. Factors that may lead to or contribute to differences in current expectations include, but are not limited to: developments in legislation, technology, tax, regulation, stock market price fluctuations, legal proceedings, regulatory investigations, competitive relationships and general economic conditions. These and other factors, risks and uncertainties that may affect any forward-looking statement or the actual results of DGB are discussed in the annual report. The forward-looking statements in this document speak only as of the date of this document. Subject to any legal obligation, DGB assumes no obligation or responsibility to update the forward-looking statements contained in this document, whether related to new information, future events or otherwise. The provision of DGB’s services and products is subject to its General Terms and Conditions.

_visual%206.png?width=1800&height=1200&name=Number%20of%20buyers%20and%20average%20retirement%20volume%20per%20buyer%20(2018-2023)_visual%206.png)

_visual%208.png?width=1800&height=1200&name=Yearly%20issuances%2c%20retirements%20and%20historical%20cumulative%20surplus%20(2017-2023)_visual%208.png)